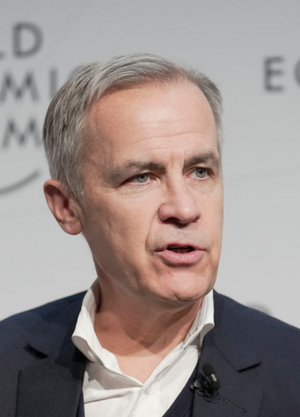

Mark Carney

Mark Carney is an economist and central banker. He holds Canadian, British and Irish citizenship and was Governor of the Bank of England from 2013 to 2020, and was chair of the Financial Stability Board from 2011 to 2018.[1]

Despite never having won any elected office at any level of government, in March 2025, he was selected to lead the Canadian Liberal Party and to replace Justin Trudeau as Prime Minister of Canada.[2] He is the first Canadian Prime Minister to have never held a seat in the House of Commons.

On 23 March 2025, Carney announced that Canada will have a general election on 28 April 2025.[3]

Contents

Deep state connections

Obviously Carney is a deep state operative, repeatedly placed in high ranking positions within several different countries - including unelected Prime Minister of Canada. He has attended a number of Bilderberg Conferences and World Economic Forum Annual Meetings, and sat on the WEF/Board of Trustees. He is a member of the Knights of Malta.

Education

Carney was born in Fort Smith, Northwest Territories, and raised in Edmonton, Alberta. He graduated with in economics from Harvard University in 1988, going on to study at the University of Oxford.

Career

Carney spent 13 years at Goldman Sachs[4] before joining the Canadian Department of Finance. He was appointed Governor of the Bank of Canada from 2008 until 2013. He then became Governor of the Bank of England from 2013 until 2020. .[5]

He was a contender to succeed the Christine Lagarde as managing director of the International Monetary Fund, after she was nominated to become the next President of the European Central Bank.[6][7]

Carney admitted that central bankers can and do decide who in our economies gets credit and who doesn't, based on their chosen agendas;

We need a whole economy transition... it's really about looking for, and at the transition plans from all companies and backing those who are part of the solution and taking capital away from those who are part of the problem.[8]

Carney came up with the idea of debanking people connected to the 2022 Freedom Convoy. He wrote a 2022 op-ed calling for "choking of the money that financed this occupation"[9], writing "Anyone sending money to the Convoy should be in no doubt: you are funding sedition".[10]

In an interview given shortly before he replaced Trudeau as leader of the Liberal Party, Carney argued that his perceived weakness - being part of the globalist inner circle—is actually his "core strength":

I know how the world works, I know how to get things done, I’m connected. People will charge me with being elitist or a globalist, to use that term, which is, well, that’s exactly, it happens to be exactly what we need.[11]

Victory speech

In his victory speech when being selected Prime Minister, Carney attacked President Trump, who has imposed tariffs on Canada and said he wants to make the country the 51st US state:

"Americans should make no mistake. In trade, as in hockey, Canada will win."[12]

Going Direct Reset, Social Responsibility, Financial Coup

On the Board of Trustees of the World Economic Forum, Larry Fink is involved with their stakeholder capitalism evangelism efforts, preaching social responsibility and inclusivity - essentially the same buzzwords used by the World Economic Forum and the Council for Inclusive Capitalism, headed by the Pope supposedly, including other members of the WEF Board of Trustees, like Mark Carney, Marc Benioff (also WEF, founder of Salesforce, and head of their Fourth Industrial Revolution Committee), etc.

In 2019 Mark Carney gave a speech on how a new economic system would be needed to move the world to a net zero economy - an economic overhaul under the guise of climate change, like a financial nuclear bomb, in terms of the the fiscal response to to COVID-19 essentially weakening even further an already weakened financial and economic system in the United States, for a new order.

In what Catherine Austin Fitts calls the Financial Coup, they've levered up the national governments to shift money out of government coffers and/or pension funds - like a bank robbery before everyone realizes the money's gone and they'll need the money back with a ruse to reconsolidate the system - total financial control that requires an electrical grid - CBDCs, a data intensive grid, and their electrical system. To control where you can travel to, turn off your money any where, any time, any place - the goal of central bank digital currencies. "Klaus Schwab in the beginning of January essentially announced before the virtual Davos Conference of this year[citation needed] that the fear and concern over COVID-19 by the end of 2021 was going to give way to Climate Change." Soon after in his annual letter, the New York Times describes, Larry Fink is pushing out the the goalpost on climate action asking companies to "disclose a plan for how their business model will be compatible with a net zero economy. With nearly a trillion dollars of investments BlackRock has a lot of influence. Last year the firm voted against 69 companies and against 64 directors for climate related reasons and it put 191 companies on watch." Since then Goldman Sachs, JP Morgan, Vanguard, and a lot of other titans of finance pivot their focus on ESGs, these environmental social governance rules for corporations, and because of BlackRock's influence, stakes, and so many corporations, it seems like they are basically planning to do sort of a corporate coup under the guise of Climate Change and institute a lot of these moves that are going to take us towards stakeholder capitalism as the WEF likes to call it.

Mark Carney and Magic Money

On 11 October 2019 George Kerevan's Mark Carney and Magic Money was published by Bella Caledonia:

Governor Mark Carney has never been one to follow fashion – he prefers to make it. So it is not any surprise he is bucking the trend among global central banks to slash interest rates to near zero and pump vast amounts of new money into the system.

The Federal Reserve is pumping $75bn into the so-called overnight money market, which is jargon for making it cheap for banks to lend to each other. The official Federal Reserve interest rate – that sets the trend for all US interest rates – has been cut twice this year and will probably be cut again soon.

Where the Fed treads, other follow. Central banks in Japan, India, Turkey, Brazil, Australia and New Zealand have cut interest rates. So far, these actions have not reversed the decline in manufacturing – but they have prevented a deeper slump. This is especially true in Europe where the German economy is tanking because of the loss of Chinese markets.

The European Central Bank (ECB) is keeping its official short interest rate at zero. It is also printing euros to buy 20bn a month of government bonds. Result: it has driven the yield on these bonds into negative territory. In other words – and daft as it seems – investors are now paying the German government to lend to it. And not just Germany. Governments lending at negative rates include France, Italy, Spain, Ireland, Portugal, Poland, Romania, Bulgaria and even Greece.

Videos 2025

| THE GREAT RESET comes to CANADA (6:49) ~ The WhatsHerFace Show, March 28, 2025. |

| Canada / USA Relationship is Over - Mark Carney (15:15) ~ Clyde Do Something, March 28, 2025. |

| An unelected globalist Prime Minister and a greedy, eager Europe ready to devour Canada. (22:29) ~ Celtic Canuck, March 26, 2025. |

| Interview 1941 – The Externalization of the Money Masters with Jacob Nordangård (40:41) ~ The Corbett Report (Unofficial), March 26, 2025. |

| Mark Carney Exposed as Great Reset Globalist (10:52) ~ Clyde Do Something, March 21, 2025. |

| New Canadian Prime Minister Comes Out LYING! w/ Anita Krishna (19:37) ~ The Jimmy Dore Show, March 19, 2025. |

| King Carnage and the globalist end game (9:21) ~ Celtic Canuck, March 19, 2025. |

| Mark Carney Just Pulled a Fast One.. (9:50) ~ Clyde Do Something, March 17, 2025. Political theatre to seem to remove the Carbon Tax without actually removing it. |

| Canada is in Crisis: How Mark Carney and the Liberals Are Destroying the Nation (14:24) ~ Redacted, March 16, 2025. |

| This is a BIG WIN for Pierre Poilievre (7:59) ~ Clyde Do Something, March 12, 2025. But who needs taxes when you can have tariff wars? |

| Liberals Select Mark Carney as Canada's Unelected Prime Minister (9:16) ~ Clyde Do Something, March 10, 2025. |

| Mark Carney is BAD husband material for Canada. (8:05) ~ Celtic Canuck, February 23, 2025. |

| A critical moment for the future of Canada (12:47) ~ Celtic Canuck, February 19, 2025. |

Events Participated in

| Event | Start | End | Location(s) | Description |

|---|---|---|---|---|

| Bilderberg/2011 | 9 June 2011 | 12 June 2011 | Switzerland Hotel Suvretta St. Moritz | 59th meeting, in Switzerland, 129 guests |

| Bilderberg/2012 | 31 May 2012 | 3 June 2012 | US Virginia Chantilly | The 58th Bilderberg, in Chantilly, Virginia. Unusually just 4 years after an earlier Bilderberg meeting there. |

| Bilderberg/2018 | 7 June 2018 | 10 June 2018 | Italy Turin Hotel Torino Lingotto Congress | The 66th Bilderberg Meeting, in Turin, Italy, known for months in advance after an unprecedented leak by the Serbian government. |

| Bilderberg/2019 | 30 May 2019 | 2 June 2019 | Switzerland Montreux | The 67th Bilderberg Meeting |

| Bilderberg/2022 | 2 June 2022 | 5 June 2022 | US Washington DC Mandarin Oriental Hotel | The 68th Bilderberg Meeting, held in Washington DC, after an unprecedented two year hiatus during which a lot of the Bilderberg regulars were busy managing COVID-19 |

| Bilderberg/2023 | 18 May 2023 | 21 May 2023 | Portugal Lisbon Pestana Palace Hotel | The 69th Bilderberg Meeting, held in Lisbon, with 128 guests on the official list. The earliest in the year since 2009. |

| Bilderberg/2024 | 30 May 2024 | 2 June 2024 | Spain Madrid | The 70th Bilderberg Meeting |

| Halifax International Security Forum/2010 | 20 November 2010 | 22 November 2010 | Canada Halifax Nova Scotia | Spooky conference in Canada in November 2010 |

| WEF/Annual Meeting/2008 | 23 January 2008 | 27 January 2008 | Switzerland WEF | At the 2008 summit, Klaus Schwab called for a coordinated approach, where different 'stakeholders' collaborate across geographical, industrial, political and cultural boundaries." |

| WEF/Annual Meeting/2009 | 23 January 2009 | 27 January 2009 | Switzerland WEF | Chairman Klaus Schwab outlined five objectives driving the Forum’s efforts to shape the global agenda, including letting the banks that caused the 2008 economic crisis keep writing the rules, the climate change agenda, over-national government structures, taking control over businesses with the stakeholder agenda, and a "new charter for the global economic order". |

| WEF/Annual Meeting/2013 | 23 January 2013 | 27 January 2013 | Switzerland WEF | 2500 mostly unelected leaders met to discuss "leading through adversity" |

| WEF/Annual Meeting/2014 | 22 January 2014 | 25 January 2014 | Switzerland WEF | 2603 guests in Davos considered "Reshaping The World" |

| WEF/Annual Meeting/2015 | 21 January 2015 | 24 January 2015 | Switzerland WEF | Attended by a lot of people. This page lists only the 261 "Public Figures". |

| WEF/Annual Meeting/2016 | 20 January 2016 | 23 January 2016 | Switzerland WEF | Attended by over 2500 people, both leaders and followers, who were explained how the Fourth Industrial Revolution would changed everything, including being a "revolution of values". |

| WEF/Annual Meeting/2017 | 17 January 2017 | 20 January 2017 | Switzerland WEF | 2952 known participants, including prominently Bill Gates. "Offers a platform for the most effective and engaged leaders to achieve common goals for greater societal leadership." |

| WEF/Annual Meeting/2019 | 22 January 2019 | 25 January 2019 | Switzerland WEF | "The reality is that we are in a Cold War [against China] that threatens to turn into a hot one." |

| WEF/Annual Meeting/2020 | 21 January 2020 | 24 January 2020 | Switzerland WEF | This mega-summit of the world's ruling class and their political and media appendages happens every year, but 2020 was special, as the continuous corporate media coverage of COVID-19 started more or less from one day to the next on 20/21 January 2020, coinciding with the start of the meeting. |

| WEF/Annual Meeting/2023 | 16 January 2023 | 20 January 2023 | Switzerland WEF | The theme of the meeting was "Cooperation in a Fragmented World" |

References

- ↑ "Bank of Canada Governor Mark Carney"

- ↑ https://www.bbc.com/news/articles/c3904r98lnlo

- ↑ "Canadian Prime Minister Mark Carney and opponent kick off their election campaigns"

- ↑ https://www.nytimes.com/2016/09/16/business/international/bank-of-england-brexit-carney.html?mcubz=0

- ↑ "Mark Carney’s term extended and Sir Jon Cunliffe re-appointed at the Bank of England"

- ↑ "Christine Lagarde faces ECB test of legendary diplomatic skills"

- ↑ "EU capitals cool on Mark Carney to succeed Christine Lagarde at IMF"

- ↑ https://www.bloomberg.com/news/videos/2020-11-18/un-special-envoy-mark-carney-on-the-future-of-energy-video

- ↑ https://www.theglobeandmail.com/opinion/article-mark-carney-end-freedom-convoy-ottawa-state-of-emergency/

- ↑ https://www.westernstandard.news/news/sedition-in-ottawa-carney-refuses-to-comment-on-his-freedom-convoy-condemnation/63497

- ↑ https://archive.is/cWSSt

- ↑ "Canada's next PM Mark Carney vows to win trade war with Trump"

- ↑ re-uploaded video: https://www.youtube.com/watch?v=bCoxTGtA_JM 14:48 - 30:46

- ↑ transcription: https://Projex.Wiki/wiki/Transcriptions