Difference between revisions of "Paul Volcker"

(Policies) |

(job tidy) |

||

| Line 25: | Line 25: | ||

|children=2 | |children=2 | ||

|employment={{job | |employment={{job | ||

| − | |title= | + | |title=Chair |

|start=February 2009 | |start=February 2009 | ||

|end=January 2011 | |end=January 2011 | ||

| + | |employer=President's Council on Jobs and Competitiveness | ||

}}{{job | }}{{job | ||

|title=Chairman of the Federal Reserve | |title=Chairman of the Federal Reserve | ||

| Line 36: | Line 37: | ||

|start=May 2, 1975 | |start=May 2, 1975 | ||

|end=August 5, 1979 | |end=August 5, 1979 | ||

| − | |||

| − | |||

| − | |||

| − | |||

}}{{job | }}{{job | ||

|title=Trilateral Commission/North American Chairman | |title=Trilateral Commission/North American Chairman | ||

Revision as of 23:25, 2 February 2024

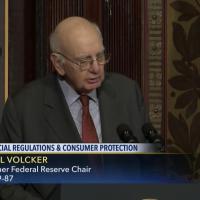

Paul Adolph Volcker, Jr. is a US economist and former Chairman of the Federal Reserve. He is a suspected US deep state actor.

Contents

Career

Volcker graduated from Princeton University in 1949 and received an M.A. from Harvard University in 1951.[1]

“In 1952, straight from the London School of Economics, Volcker joined the Federal Reserve Bank of New York as an economist. He stayed for five years, until 1957, at which time Volcker moved from Liberty Street to become an economist for Chase Manhattan Bank, where he stayed for four years, until 1961. In 1961, Volcker went to the Treasury Department in Washington, thus completing the first round of his three stop "revolving door." Appointed as Deputy Undersecretary for Monetary Affairs, he held that job just long enough to learn the ropes in Washington, and returned to New York, to Chase Manhattan Bank, as Vice President in charge of Planning. After three years in that post, Volcker left in 1969 to become Undersecretary for Monetary Affairs at the U. S. Treasury Department. After five years, Volcker completed the second round of his "revolving door" with an appointment as President of the Federal Reserve Bank of New York.

Volcker is also a member of the Council on Foreign Relations, the Rockefeller Foundation and the American Friends of the London School of Economics.

If Paul Volcker was a solitary phenomenon, we could make no case for Trilateral control of the Federal Reserve System. In fact, the Volcker phenomenon is one of a dozen parallel situations.”

Anthony Sutton [2]

Policies

Gold

Appointed by the Nixon Administration, Volcker served under secretary of the Treasury for international monetary affairs from 1969 to 1974. He was the "principal planner" [3] of Richard Nixon's decision to suspend gold convertibility of the dollar on August 15, 1971,[4][5][6] which resulted in the collapse of the Bretton Woods system. Volcker considered the suspension of gold convertibility "the single most important event of his career."[7][8]

Volcker shock

The Volcker Shock was a period of historically high interest rates precipitated by Federal Reserve Chairperson Paul Volcker's decision to raise the central bank's key interest rate, the Fed funds effective rate, during the first three years of his term. Volcker was appointed chairperson of the Fed in August 1979 by President Jimmy Carter, as replacement for William Miller, who Carter had made his treasury secretary. Volcker was one of the most hawkish (supportive of tighter monetary policy to stem inflation) members of the Federal Reserve's committee, and quickly set about changing the course of monetary policy in the U.S. in order to quell inflation. The Volcker Shock is remembered for bringing an end to over a decade of high inflation in the United States, prompting a deep recession and high unemployment, and for spurring on debt defaults among developing countries in Latin America who had borrowed in US dollars.[9] Some say it helped to bring about the end of the Soviet Union.[10]

Deep political connections

Attended Le Cercle.

A Quote by Paul Volcker

| Page | Quote | Date |

|---|---|---|

| The Great Reset | “A controlled disintegration of the world economy is a legitimate object for the 1980s.” | November 1978 |

Events Participated in

| Event | Start | End | Location(s) | Description |

|---|---|---|---|---|

| Bilderberg/1982 | 14 May 1982 | 16 May 1982 | Norway Sandefjord | The 30th Bilderberg, held in Norway. |

| Bilderberg/1983 | 13 May 1983 | 15 May 1983 | Canada Quebec Château Montebello | The 31st Bilderberg, held in Canada |

| Bilderberg/1986 | 25 April 1986 | 27 April 1986 | Scotland Gleneagles Hotel | The 34th Bilderberg, 109 participants |

| Bilderberg/1987 | 24 April 1987 | 26 April 1987 | Italy Cernobbio | 35th Bilderberg, in Italy, 106 participants |

| Bilderberg/1988 | 3 June 1988 | 5 June 1988 | Austria Interalpen-Hotel Telfs-Buchen | The 36th meeting, 114 participants |

| Bilderberg/1992 | 21 May 1992 | 24 May 1992 | France Royal Club Evian Evian-les-Bains | The 40th Bilderberg. It had 121 participants. |

| Bilderberg/1997 | 12 June 1997 | 15 June 1997 | US Lake Lanier Georgia (State) | The 45th Bilderberg meeting |

| Bilderberg/2009 | 14 May 2009 | 17 May 2009 | Greece Vouliagmeni | The 57th Bilderberg |

| Bilderberg/2010 | 3 June 2010 | 6 June 2010 | Spain Hotel Dolce Sitges Barcelona | The 122 guests met in the Hotel Dolce Sitges, Barcelona, Spain. |

References

- ↑ https://www.britannica.com/biography/Paul-Adolph-Volcker

- ↑ The Federal Reserve Conspiracy p. 109

- ↑ "VOLCKER: I certainly was a major proponent of suspending gold convertibility, in fact the principal planner." https://pubs.aeaweb.org/doi/pdfplus/10.1257/jep.27.4.105 saved at Archive.org

- ↑ https://www.gold-eagle.com/article/paul-volcker-man-who-vanquished-gold

- ↑ https://www.federalreservehistory.org/essays/gold-convertibility-ends

- ↑ Papua New Guinea Post-Courier, Port Moresby, National Capital District, Papua New Guinea, Tue, Aug 17, 1971, Page 7

- ↑ William L. Silber, 2013, Volcker: The Triumph of Persistence, Bloomsbury Press, ISBN 978-1-620-40292-4, page 2.

- ↑ https://www.aier.org/article/volcker-and-the-great-inflation-reflections-for-2022/

- ↑ https://www.statista.com/statistics/1338105/volcker-shock-interest-rates-unemployment-inflation/

- ↑ https://www.hoover.org/events/soviet-umbrella-and-volcker-shock-michael-de-groot