Revolving door

| |

| Interest of | • Honeywell • Powerbase • Spinwatch • WestExec Advisors |

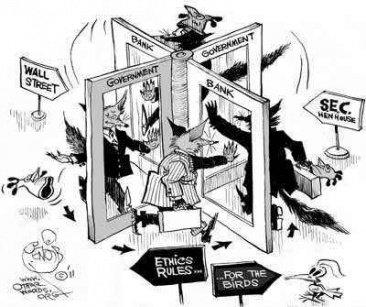

In politics the revolving door is the movement of personnel in government positions on one hand, and members of the industries back and forth.

Contents

Official narrative

About John Sawers moved to become non-executive director of BP in 2015, the UK Foreign office "said it had accepted the application from Sawers to join BP on condition that "he should not draw on privileged information available to him from his time in the secret service"."[1]

Concerns

The revolving door leads to regulatory capture.[2] Regulating bodies created to protect the public interest become populated or influenced by members of the industries. This can and does shift in policy that favours industry over the public interest.

International

This system is not at all limited to only the US or Britain. Anders Fogh Rasmussen, PM of Denmark, was later rewarded by the military-industrial complex for his political work, by being selected to become General Secretary of NATO. After that position, he was again rewarded by becoming a consultant for Goldman Sachs. [3]

Selected Examples

Glenn Greenwald has described Booz Allen Hamilton as "the perfect embodiment of" the revolving door syndrome in Washington.[4] Watchdog.org reported in August 2016 that: "more than 250 people have moved from Google and related firms to the federal government or vice versa since President Barack Obama took office."[5]

The reach of Goldman Sachs into government has lead to the creation of the term "Government Sachs".[6] The revolving door phenomenon of this investment bank has become part of commercially-controlled media reporting.[7]

Sourcewatch has a separate page entitled "EPA's Revolving Door".[8]

Wikipedia

Wikipedias explanation for the revolving door is a very good example of the gaslighting that is going on there, it reads:[9]

Political analysts claim that an unhealthy relationship can develop between the private sector and government, based on the granting of reciprocated privileges to the detriment of the nation, and can lead to regulatory capture.

That this has become kind of a problem these days is not even a question anymore.

Spooks

In earlier decades senior spooks tended to take non-commercial, non-political posts such as responsibilities in charities such as the national trust. In the 21st century, they are increasingly being employed by banks such as HSBC, or sometimes arms companies, ostensibly in a bid to "increase security" or advise about the dangers posed by "terrorists".[10]

Privatisation

- Full article: Privatisation

- Full article: Privatisation

The effect of the revolving door has been amplified since the 90s by privatisation, but especially after the start of the war on terror.

A Revolving door victim on Wikispooks

| Title | Description |

|---|---|

| Boeing | US based arms manufacturer which also makes civilian aircraft that since the 1990s have became known for their sometimes dubious reliability. |

Related Quotations

| Page | Quote | Author |

|---|---|---|

| Tom Cotton | ““It has come to our attention while observing your nuclear negotiations with our government that you may not fully understand our constitutional system. Thus, we are writing to bring to your attention two features of our Constitution—the power to make binding international agreements and the different character of federal offices—which you should seriously consider as negotiations progress.

First, under our Constitution, while the president negotiates international agreements, Congress plays the significant role of ratifying them. In the case of a treaty, the Senate must ratify it by a two-thirds vote. A so-called congressional-executive agreement requires a majority vote in both the House and the Senate (which, because of procedural rules, effectively means a three-fifths vote in the Senate). Anything not approved by Congress is a mere executive agreement. Second, the offices of our Constitution have different characteristics. For example, the president may serve only two 4-year terms, whereas senators may serve an unlimited number of 6-year terms. As applied today, for instance, President Obama will leave office in January 2017, while most of us will remain in office well beyond then—perhaps decades. What these two constitutional provisions mean is that we will consider any agreement regarding your nuclear-weapons program that is not approved by Congress as nothing more than an executive agreement between President Obama and Ayatollah Khamenei. The next president could revoke such an executive agreement with the stroke of a pen and future Congresses could modify the terms of the agreement at any time."” | Tom Cotton |

| Paul Volcker | “In 1952, straight from the London School of Economics, Volcker joined the Federal Reserve Bank of New York as an economist. He stayed for five years, until 1957, at which time Volcker moved from Liberty Street to become an economist for Chase Manhattan Bank, where he stayed for four years, until 1961. In 1961, Volcker went to the Treasury Department in Washington, thus completing the first round of his three stop "revolving door." Appointed as Deputy Undersecretary for Monetary Affairs, he held that job just long enough to learn the ropes in Washington, and returned to New York, to Chase Manhattan Bank, as Vice President in charge of Planning. After three years in that post, Volcker left in 1969 to become Undersecretary for Monetary Affairs at the U. S. Treasury Department. After five years, Volcker completed the second round of his "revolving door" with an appointment as President of the Federal Reserve Bank of New York.

Volcker is also a member of the Council on Foreign Relations, the Rockefeller Foundation and the American Friends of the London School of Economics. If Paul Volcker was a solitary phenomenon, we could make no case for Trilateral control of the Federal Reserve System. In fact, the Volcker phenomenon is one of a dozen parallel situations.” | Paul Volcker Antony Sutton |

References

- ↑ http://uk.reuters.com/article/2015/05/14/uk-bp-board-idUKKBN0NZ14K20150514

- ↑ https://people.howstuffworks.com/what-is-the-revolving-door1.htm

- ↑ https://www.bloomberg.com/news/articles/2015-08-05/goldman-hires-ex-nato-chief-to-guard-1-5-billion-danish-stake

- ↑ http://www.salon.com/2010/03/29/mcconnell_3/

- ↑ https://web.archive.org/web/20160809144013/http://watchdog.org/265844/google-obama-revolving-door/

- ↑ https://www.opensecrets.org/news/2017/03/revolving-door-goldman-sachs/ saved at Archive.org saved at Archive.is

- ↑ https://www.cbsnews.com/news/goldman-sachs-revolving-door/ saved at Archive.org saved at Archive.is

- ↑ http://www.sourcewatch.org/index.php/EPA%27s_Revolving_Door

- ↑ http://archive.today/2020.07.03-213617/https://en.wikipedia.org/wiki/Revolving_door_(politics)

- ↑ For example, Sherard Cowper-Coles