De Beers

(Mining company) | |

|---|---|

De Beers' headquarters at 17 Charterhouse Street, London | |

| Formation | 1888 |

| Founder | |

| Headquarters | 17 Charterhouse Street, |

| Leader | De Beers/CEO |

| Staff | 20,000 |

| Slogan | A Diamond Is Forever |

| Interest of | Laurie Flynn |

| Owner of | International Diamond Security Organisation |

| Exposed by | Gordon Douglas Brown |

| Subpage | •De Beers/CEO |

De Beers is a family of companies that dominate the diamond, diamond mining, diamond trading and industrial diamond manufacturing sectors. De Beers is active in every category of industrial diamond mining: open-pit, underground, large-scale alluvial, coastal and deep sea.[1] Mining takes place in Botswana, Namibia, South Africa and Canada.

Having taken control of De Beers in 2011, Anglo American announced plans to sell off the company in 2024.[2]

Contents

- 1 Origins

- 2 2000s

- 3 Company history

- 4 Activities

- 5 Business structure

- 6 Marketing

- 7 Legal issues on monopolising and fixing prices

- 8 Conflict diamonds and the Kimberley Process

- 9 Forceful relocation of indigenous people

- 10 "The Case of the Disappearing Diamonds"

- 11 Charity premiere of "Chaplin"

- 12 Lockerbie's "polished gangsters"

- 13 Related Documents

- 14 References

- 15 External links

Origins

The company was founded by deep politician Cecil Rhodes, financed by Alfred Beit and N M Rothschild & Sons.[3] In 1927, Ernest Oppenheimer, a German immigrant to Britain who had earlier founded mining giant Anglo American plc with American financier J.P. Morgan,[4] took over De Beers. He built and consolidated the company's global monopoly over the diamond industry until his retirement. During this time, he was involved in a number of controversies, including price fixing, antitrust behaviour and an allegation of not releasing industrial diamonds for the US war effort during World War II.[5][6]

2000s

In January 2010, former De Beers employee Gordon Brown pointed the finger of suspicion at De Beers/Anglo American 'polished gangsters' for the targeting of UN Commissioner for Namibia, Bernt Carlsson, on Pan Am Flight 103 of 21 December 1988. (In January 2001, the Libyan Abdelbaset al-Megrahi had controversially been convicted for the crime, many believing that al-Megrahi and Libya had nothing to do with the Lockerbie bombing.)[7]

On 4 November 2011, two weeks after the capture and killing of Muammar Gaddafi in Libya, Ernest's grandson Nicky sold the Oppenheimer dynasty's 40% stake in De Beers to Anglo American for $5.1 billion, thus ending its century-old involvement in the diamond industry.[8] Nicky Oppenheimer heads South Africa’s richest family, whose $7-billion fortune makes him the 136th richest person in the world, according to Forbes magazine.[9]

Company history

Cecil Rhodes, the founder, got his start by renting water pumps to miners during the diamond rush that started in 1871, when an 83.5 carat diamond was found on Colesburg Kopje (or Kimberley), South Africa. He invested the profits of this operation into buying up claims of small mining operators, with his operations soon expanding into a separate mining company. He soon secured funding from the Rothschild family, who would finance his business expansion.[10] [11]

De Beers Consolidated Mines was formed in 1888 by the merger of the companies of Barney Barnato and Cecil Rhodes, by which time the company was the sole owner of all diamond mining operations in the country.[12][13] The name derived from the De Beers brothers, Diederik Arnoldus and Johannes Nicolaas de Beers, Boers whose farm had become the site of a particularly lucrative mine, although they'd sold the claim and had no involvement with the company that came to bear their name. In 1889, Rhodes negotiated a strategic agreement with the London-based Diamond Syndicate, which agreed to purchase a fixed quantity of diamonds at an agreed price, thereby regulating output and maintaining prices.[14] The agreement soon proved to be very successful — for example during the trade slump of 1891–1892, supply was simply curtailed to maintain the price.[15] Rhodes was concerned about the break-up of the new monopoly, stating to shareholders in 1896 that:

- "Our only risk is the sudden discovery of new mines, which human nature will work recklessly to the detriment of us all."

The Second Boer War proved to be a challenging time for the company. Kimberley was besieged as soon as war broke out, thereby threatening the company's valuable mines. Rhodes personally moved into the city at the onset of the siege in order to put political pressure on the British government to divert military resources towards relieving the siege rather than more strategic war objectives. Despite being at odds with the military,[16] Rhodes placed the full resources of the company at the disposal of the defenders, manufacturing shells, defences, an armoured train and a gun named Long Cecil in the company workshops.[17]

In 1902, a competitive mine named the Cullinan mine was discovered; however its owner refused to join the De Beers cartel.[18] Instead, the mine started selling to a pair of independent dealers named Bernhard and Ernest Oppenheimer, thereby weakening the De Beers cartel. Production soon equalled all of the De Beers mines combined, as well as yielding the largest rough diamond ever discovered, the Cullinan diamond. Ernest Oppenheimer was appointed the local agent for the influential London Syndicate, rising to the position of mayor of Kimberley within 10 years. He understood the core principle that underpinned De Beers success, stating in 1910 that:

- "Common sense tells us that the only way to increase the value of diamonds is to make them scarce, that is to reduce production."

During World War I, the Cullinan mine was finally absorbed into De Beers. When Rhodes died in 1902, De Beers controlled 90% of the world's diamond production. Ernest Oppenheimer took over the chairmanship of the company in 1927, after buying a seat on the board a year earlier.[19]

Oppenheimer was very concerned about the discovery of diamonds in 1908 in German South West Africa (now Namibia), fearing that the increased supply would swamp the market and force prices down.

Former CIA chief, Admiral Stansfield Turner, claimed that De Beers restricted US access to industrial diamonds needed for the country's war effort during World War II.[20]

Diamond monopoly

De Beers is well known for its monopoloid practices throughout the 20th century, whereby it used its dominant position to manipulate the international diamond market.[21] The company used several methods to exercise this control over the market: Firstly, it convinced independent producers to join its single channel monopoly, it flooded the market with diamonds similar to those of producers who refused to join the cartel, and lastly, it purchased and stockpiled diamonds produced by other manufacturers in order to control prices through supply.

In May 2000, just as the Lockerbie bombing trial began, the De Beers model changed,[22] due to factors such as the decision by producers in Russia, Canada and Australia, to distribute diamonds outside of the De Beers channel,[23] as well as rising awareness of blood diamonds that forced De Beers to "avoid the risk of bad publicity" by limiting sales to its own mined products.[24] De Beers’ market share fell from as high as 90% in the 1980s to less than 40% in 2012.[25]

In November 2011, following the murder of Muammar Gaddafi during the NATO bombing of Libya, the Oppenheimer family announced their intention to sell the entirety of their 40% stake in De Beers to Anglo American plc thereby increasing its ownership of the company to 85%.[26] The transaction was worth £3.2 billion ($5.1bn) in cash and ended the Oppenheimer dynasty's eighty year ownership of the world's largest diamond miner.[27]

CSO cartel

In May 2000, De Beers announced that its London-based Central Selling Organisation (CSO) is to cease mopping up spare diamond supplies around the world in order to hold up prices, and will be abandoning its role as international policeman for the industry.

In years gone by, this has involved the use of secret agents, freelance spies and a private intelligence network spanning Europe and Africa.

Now De Beers - shaken by the colossal expense of trying to stabilise the market during the turbulent 1990s - is to put its own shareholders first and aim instead to be the industry's "preferred supplier" rather than buyer and seller of last resort. To stave off what would otherwise be a glut of stones on the market, De Beers is proposing instead massive saturation advertising and marketing around the world to beef up demand.

Managing Director Gary Ralfe hopes to use De Beers' dominant position to persuade everyone in the industry to spend much more on marketing, and has confirmed the company is to continue its famous generic advertisements with the slogan "A diamond is forever". The CSO - which makes no profit at all on its operations - will continue to function, but primarily as the marketing arm of De Beers, whose own mines produce about half the world's diamonds.[28]

Activities

Mining in Botswana takes place through the mining company Debswana,[29] a 50–50 joint venture with the Government of the Republic of Botswana. In Namibia it takes place through Namdeb,[30] a 50–50 joint venture with the Government of the Republic of Namibia. Mining in South Africa takes place through De Beers Consolidated Mines (DBCM),[31] 74% owned by DeBeers and 26% by a broad based black economic empowerment partner, Ponahalo Investments. In 2007 De Beers began production at the Snap Lake Mine in Northwest Territories, Canada;[32] this is the first De Beers mine outside of Africa. In July 2008 De Beers opened the Victor Mine in Ontario, Canada.[33]

Trading of rough diamonds takes place through the Diamond Trading Company via wholly owned and joint venture operations in South Africa (DTCSA), Botswana (DTCB), Namibia (NDTC) and the United Kingdom (DTC). The various DTCs sort, value and sell approximately 40%[34] of the world's rough diamonds by value.

The Family of Companies employs about 20,000 people around the world on five continents, with 17,000 employees in Africa. Over 7,000 people are employed in Botswana, over 7,100 in South Africa, 3,800 in Namibia, 700 in Canada and over 800 in Group Exploration.[35]

Business structure

On 4 November 2011, Anglo American plc and CHL Holdings announced their agreement for Anglo American to acquire an incremental interest in De Beers, increasing Anglo American's current 45% shareholding in the world's leading diamond company to up to 85%.[36] De Beers Investments is the privately held, ownership company of De Beers Société Anonyme (DBSA), and is registered in Luxembourg. It is made up of two shareholdings: Anglo American plc has a 85% shareholding and the Government of the Republic of Botswana owns 15% directly. De Beers Societe Anonyme (DBSA) is the management company of the De Beers group.[37]

The Family of Companies

The De Beers Family of Companies is involved in most parts of the diamond value chain. Companies are as follows:

- De Beers Canada – mining

- De Beers Consolidated Mines – mining

- De Beers Diamond Jewellers – retail

- Debswana – mining

- Diamdel – trading

- Diamond Trading Company – trading

- Diamond Trading Company Botswana – trading

- Diamond Trading Company South Africa – trading

- Element Six – Advanced Materials / industrial diamonds

- Forevermark – retail

- Namdeb – mining

- Namibia Diamond Trading Company – trading

The Diamond Trading Company

The Diamond Trading Company, the rough diamond sales and distribution arm of the De Beers Group, sorts, values and sells approximately 40% of the world's rough diamonds by value. Currently the DTC has a combination of wholly owned and joint venture operations in South Africa (DTCSA), Botswana (DTCB), Namibia (NDTC) and the United Kingdom (DTC).

Diamonds sold by the DTC are sourced primarily from De Beers' own mining operations in South Africa and Canada, and through its joint venture partnerships with the governments of Botswana, and Namibia.

De Beers Diamond Jewellers

In 2001, De Beers entered into a retail joint venture with French luxury goods company Louis Vuitton Moet Hennessy[38] (LVMH) to establish an independently managed De Beers diamond jewellery company. The joint venture, called De Beers Diamond Jewellers Ltd, sells diamond jewellery. The first De Beers boutique opened in 2002 on London's Old Bond Street as the brand's flagship store, and since then has opened stores all around the world.[39]

Marketing

De Beers has run a decades-long campaign to effectively create a consumer demand for diamonds.[40]

A young copywriter working for N. W. Ayer & Son, Frances Gerety, coined the famous advertising line "A Diamond is Forever" in 1947.[41] In 2000, Advertising Age magazine named "A Diamond Is Forever" the best advertising slogan of the twentieth century.[42]

Other successful campaigns include the "eternity ring" (as a symbol of continuing affection and appreciation),[43] the "trilogy" ring (representing the past, present and future of a relationship) and the "right hand ring" (bought and worn by women as a symbol of independence).[44]

De Beers is also known for its television advertisements featuring silhouettes of people wearing diamonds, to the music of Palladio by Karl Jenkins. The campaign, titled "Shadows and Lights", first ran in the spring of 1993. The song would later inspire for a compilation album, Diamond Music, released in 1996, which features the Palladio suite. A 2010 commercial for Verizon Wireless parodied the De Beers spots.[45]

Forevermark

De Beers has introduced Forevermark diamonds to markets in China, Hong Kong, India, Japan, and the United States. According to the company, forevermark diamonds, "are natural, untreated, responsibly sourced, and cut and polished by a specially selected diamantaire."[46] Forevermark diamonds have an icon and identification number inscribed on the table facet of the diamond. The inscription is about 0.05 µm deep and applied using an undisclosed De Beers technology developed in Maidenhead, United Kingdom, and Antwerp, Belgium.

Legal issues on monopolising and fixing prices

Sherman Antitrust Act

During World War II, Ernest Oppenheimer attempted to negotiate a way around the Sherman Antitrust Act by proposing that De Beers register a US branch of the Diamond Syndicate Incorporated. In this way, his company could provide the US with the industrial diamonds it desperately sought for the war effort in return for immunity from prosecution after the war; however his proposal was rejected by the US Justice Department when it was discovered that De Beers had no intention of stockpiling any industrial diamonds in the US. In 1945, the Justice Department finally filed an antitrust case against De Beers, but the case was dismissed as the company had no presence on US soil.[47]

Gem diamonds

From 2001 onwards several lawsuits were filed against De Beers in US State and Federal courts. These alleged that De Beers unlawfully monopolised the supply of diamonds and conspired to fix, raise and control diamond prices. Additionally there were allegations of misleading advertising. While De Beers denied all allegations that it violated the law, in November 2005, De Beers announced that an agreement had been reached to settle civil class action suits filed against the company in the United States, and in March 2006, three other civil class action suits were added to the November agreement. In April 2008, De Beers confirmed that Judge Chesler of the US Federal District Court in New Jersey had entered an order approving the Settlement, resulting in a settlement arrangement totalling $295 million USD. De Beers does not admit liability. As part of the settlement, persons who purchased gem diamonds from 1 January 1994 to 31 March 2006, may be eligible for compensation.[48]

Industrial diamonds

In 2004, De Beers pled guilty and paid a $10 million fine to the United States Department of Justice to settle a 1994 charge that De Beers had colluded with General Electric, which was acquitted of all charges, to fix the price of industrial diamonds.[49][50]

EU Competition Directorate

In February 2006, De Beers entered into legally binding commitments with the European Union Competition Directorate (DGIV) to cease purchasing rough diamonds from Alrosa as of the end of 2008.[51] In January 2007, the Competition Directorate announced it had closed the file due to lack of Community Interest. The Commission decision is under appeal before the Court of First Instance in Luxemburg.[52]

Conflict diamonds and the Kimberley Process

In 1999 a campaign by Global Witness to highlight the role of diamonds in international conflicts led to a review by the United Nations. The initial focus of the UN's investigation was on Jonas Savimbi's UNITA movement in Angola, which was found to have bartered uncut diamonds for weaponry despite international economic and diplomatic sanctions being in effect through United Nations Security Council Resolution 1173.[53][54]

In 1999, De Beers claimed to have stopped all outside buying of diamonds in order to guarantee the conflict-free status of their diamonds effective from 26 March 2000.[55][56][57]

In December 2000, following the recommendations of the Fowler Report, the UN adopted the landmark General Assembly Resolution A/RES/55/56[58] supporting the creation of an international certification scheme for rough diamonds. By November 2002, negotiations between governments, the international diamond industry and civil society organisations resulted in the creation of the Kimberley Process Certification Scheme (KPCS), which sets out the requirements for controlling rough diamond production and trade and became effective in 2003.

De Beers states that 100% of the diamonds it now sells are conflict-free and that all De Beers diamonds are purchased in compliance with national law, the Kimberley Process Certification Scheme[59] and its own Diamond Best Practice Principles.[60] The Kimberley process has helped restore the reputation of the industry, as well as eliminating sources of excess supply.[61]

Forceful relocation of indigenous people

In Botswana, a long dispute has existed between the interests of the mining company, De Beers, and the relocation of the Bushman tribe from the land, in order to exploit diamond resources. The Bushmen have been facing threats from government policies since at least 1980, when the diamond resources were discovered.[62] A campaign is being fought in an attempt to bring an end to what the indigenous rights organisation, Survival International considers it to be a genocide of a tribe that has been living in those lands for tens of thousands of years.[63][64][65] On the grounds that their hunting and gathering has become obsolete and their presence is no longer compatible with preserving wildlife resources, the Gwi and Gana people were persecuted by the government of Botswana in order to make them leave the central Kalahari nature reserve. To get rid of them, they had their water supplies cut off, they have been "taxed, fined, beaten, and tortured."[66] Several international fashion models, including Iman, Lily Cole and Erin O'Connor, who were previously involved with advertising for the companies' diamonds, have backed down after realising the consequences raised by this scandal, and now support the campaign.[67]

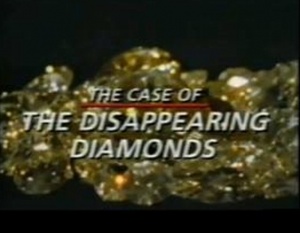

"The Case of the Disappearing Diamonds"

"The Case of the Disappearing Diamonds" is a Granada TV World In Action documentary film which reported on how billions of pounds-worth of gem diamonds were stripped from South-West Africa (Namibia) over a 20-year period by De Beers, the world's largest diamond mining company. The 30-minute film was broadcast by Thames Television on 28 September 1987.[68] It is available in 4 parts on YouTube: Part 1, Part 2, Part 3, Part 4.

The highest profile victim of Pan Am Flight 103, Assistant Secretary-General of the United Nations and UN Commissioner for Namibia, Bernt Carlsson, was interviewed in Part 3, and threatened to prosecute "all the companies which are carrying out activities in Namibia which have not been authorised by the United Nations."[69]

Narrative

After the First World War, Ernest Oppenheimer held the monopoly over the mining and sale of South West African diamonds, and formed Consolidated Diamond Mines (CDM) which was owned by De Beers. The voice-over narration by John Coates begins:

- Tonight we report on the dark side of the diamond industry. We show how one of the world's richest companies has been stripping one of the world's poorest nations of its main asset - diamonds from this mine. Namibia - a forgotten country long denied its independence. Here for 20 years, South Africa has ignored international law, occupied the land by force and refused to allow the formation of a democratic government. Behind the cover of a military occupation, Namibia has been robbed of its mineral wealth. Here a mining company has leased the world's largest diamond workings, taken £5 billion-worth of gems and paid a rent of £130 per year. At the mouth of the Orange River, an accident of geology and the sands of time has laid down one of nature's rarest gifts to mankind - lonely beaches encrusted with the finest gem diamonds in the world. Released by volcanic activity inland, the diamonds were originally thrown into the Orange River, then over the centuries they were washed downstream and taken to the sea. Incoming tides put the finishing touches bringing the diamonds ashore.

Interviewees

In sequence, the following were interviewed in "The Case of the Disappearing Diamonds":

Martyn Marriott

Described as a Diamond Consultant, Mr Martyn Marriott, stated:

- "It's well known they're the finest diamonds in the world - the highest quality, best colour, lovely diamonds. They are water-worn, thrown up into the beach and a very nice shape. They just happen to be good quality and good colour as well. The diamonds from Namibia are worth an average $200 per carat whereas the diamonds from Zaïre would be worth $8 per carat."

Eric Lang

Businessman Eric Lang said:

- "Successive Administrator-Generals allowed the mining companies to get away with exporting 20-25% of production without any control whatsoever."

Lang threatened to release Namibia's mineral statistics, to which countries they were being sold and at what prices. Lang said he believes that the plunder of his country's resources could lead to another famine in Africa, and that the people of Namibia had lost their equivalent of North Sea Oil - what would have given them a secure future.

- "Namibia's economy is extremely sick - the government consumes 75% of GDP to run the country which, today, is the second most indebted country on the African continent - from a debt-free nation seven years ago. The situation in Namibia could become far more serious than Angola and Mozambique. Without international aid, Namibia could turn into the Ethiopia of Southern Africa."

Gordon Douglas Brown

- Full article: Gordon Douglas Brown

- Full article: Gordon Douglas Brown

Former CDM manager, Gordon Brown, claimed that for 20 years De Beers had been stripping Namibia of its most precious asset - diamonds at Oranjemund.[70]

- "Overmining took place on the upper terraces and the 'N' blocks [in the upper terraces, blocks K, L, and M were rich in diamonds and the richest of all were the 'N' blocks] which were the series of beaches situated furthest from the sea. That's where the richest blocks were in terms of grade and stone size. There was a central block between the two major beaches that was of lower grade. That was left behind - the company concentrated on taking out the ore reserves furthest from the sea. That's not good mining practice. Proper mining practice calls for the average ore reserve grade and average stone size. I would liken this to a nice big cream cake, with a sponge cake below. Normally you would take out a slice at a time, but in the case of overmining the cream is completely scraped off the top."

John Shaedonhodi

A Namibian and a CDM worker, John Shaedonhodi, said he was concerned that a future independent Namibia would be impoverished.

Bernt Carlsson

- Full article: Bernt Carlsson

- Full article: Bernt Carlsson

The man responsible for Namibia under international law, Assistant Secretary-General of the United Nations and UN Commissioner for Namibia, Bernt Carlsson, was asked about the exploitation of Namibia's diamonds:

- "The corporation has been trying to skim the cream which means they have gone for the large diamonds at the expense of the steady pace. In this way they have really shortened the lifespan of the mines. One would expect from a worldwide corporation like De Beers and Anglo American that they would behave with an element of social and political responsibility. But their behaviour in the specific case of Namibia has been one of profit maximation regardless of its social, economic, political and even legal responsibility."

The United Nations Council for Namibia enacted in 1974 a Decree for the Protection of the Natural Resources of Namibia, under which no person or entity could search for, take or distribute any natural resources found in Namibia without the Council's permission. Any person or entity contravening the Decree could be held liable for damages by the future government of an independent Namibia.[71] Companies like De Beers have ignored the law but now attitudes at the UN are beginning to harden:

- "The United Nations this year [1987] in July started legal action against one such company - the Dutch company URENCO which imports uranium."[72]

John Coates: Will you be taking action against other companies such as De Beers?

- Bernt Carlsson: "All the companies which are carrying out activities in Namibia which have not been authorised by the United Nations are being studied at present."

Thirion Report

The documentary referred to a wide-ranging investigation carried out by South African Judge Pieter Willem Thirion in 1982 into political corruption and the divisive tribal structures imposed on Namibia by the apartheid government. Judge Thirion extended his investigation into the behaviour of multinational mining companies in the former German colony and found:

- at one mine 420,000 tonnes of ore were sent out of the country as "geological samples";

- at another, the state leased the mining rights to a businessman at £1,500 per year, who then reassigned them for an income of £650,000 per year;

- at the British owned Tsumeb mine, lead and copper were exported with undisclosed amounts of gold and silver;

- and the British South-West Africa Company exported £7 million-worth of minerals without paying tax.

Judge Thirion focused upon the stewardship of the nation's principal economic resource - gem diamonds of the Atlantic beaches north of the Orange River. The Thirion Report's main findings were:

- There were no meaningful controls over Namibia's most important industry;

- The premises of the supposedly independent Diamond Board for South-West Africa were provided by De Beers;

- All of the Board's agents were De Beers' employees;

- The entire costs of running the Board were met by De Beers as a tax deductible expense;

- Stanley Jackson, the Diamond Board Secretary, was also Secretary to Consolidated Diamond Mines.

The 350-page report found that De Beers had overmined the diamond reserves ahead of Namibia's independence: The excessive depletion of the deposit was a preferential depletion of the more valuable deposits to the detriment of the low grade deposits, and therefore a breach of the provisions of Clause 3 of the Halbscheid Agreement. The probabilities are that the effect of the excessive depletion of the deposit will be to shorten the life of the mine and to detrimentally affect its profitability towards the end of its life.[73]

Credits

- Camera: Howard Somers;

- Sound: David Woods;

- Film Editors: Oral Ottey, John Rutherford;

- Dubbing Mixer: John Whitworth;

- Production Assistants: Adele McLoughlin, Judith Fraser;

- Investigation by: Laurie Flynn and John Coates;

- Editor: Stuart Prebble;

- Executive Producer: Ray Fitzwalter;

- Granada Television 1987.

Diamonds Are Not Forever

One month after "The Case of the Disappearing Diamonds" was broadcast on British television, former Consolidated Diamond Mines manager, Gordon Brown, who was interviewed in the film, wrote from Cape Town to Bernt Carlsson in New York offering his expert assistance in building the prosecution case against De Beers for overmining Namibia's diamond gemstones. In his letter, Gordon Brown had calculated the quantum and value of diamonds illegally removed from Namibia from 1967, when South-West Africa became the responsibility of the United Nations, until the territory was likely to become independent in 1989/90. By which time, De Beers/Anglo American and the Apartheid State would have illegally removed:

- 44 million Diamonds, weighing

- 33 million Carats, with an average diamond size of

- 0.75 Carats per Diamond.

In 2010, Gordon Brown estimated the current value of those illegally removed diamonds amounted to:

- £11.0 billion, ($18.7bn) being Revenue from Diamond Sales (Standard Selling Value)

- £ 3.3 billion, ($ 5.6bn) spent on Working Costs and Capital Expenditure, leaving

- £ 7.7 billion, ($13.1bn) of Working Profit, distributed as follows:

- £ 4.4 billion, ($ 7.5bn) as De Beers/Anglo American’s Profit Share, and

- £ 3.3 billion, ($ 5.6bn) as Apartheid State’s Profit Share through Taxes, Royalties, etc.

Bernt Carlsson's letter

Bernt Carlsson replied by letter dated 19 November 1987:

- Reference: C-4013

- Dear Mr Brown,

- Thank you for your letter dated 20 October 1987, in which you expressed interest to be of assistance to this Office with regard to the over-exploitation of the Namibian diamonds.

- The United Nations Council for Namibia is still in the process of examining the appropriate action to take in order to halt the over-exploitation and depletion of Namibia's diamond resource. I note with interest your extensive experience in and in-depth knowledge of the diamond industry and CDM activities. We will, therefore, retain your letter on our files and, should the need arise, contact you for assistance in the matter.

- Yours truly,

- Bernt Carlsson

- United Nations Commissioner for Namibia

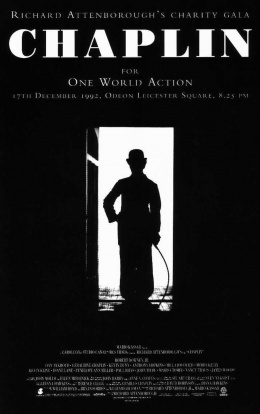

Charity premiere of "Chaplin"

On 17 December 1992, the charity premiere of Richard Attenborough's film "Chaplin" took place in London at the Odeon Cinema, Leicester Square. Glenys Kinnock hosted the event which was organised by the PR firm, Julia Hobsbawm Associates, and which raised £40,000 for the charity One World Action.

Suggested souvenir programme entry

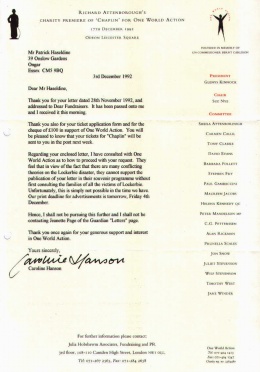

Three weeks earlier, Lockerbie campaigner Patrick Haseldine had written to Julia Hobsbawm Associates asking if the latest of his letters to The Guardian [74] could be reproduced in the "Chaplin" souvenir programme. The PR firm's Caroline Hanson replied by letter dated 3 December 1992:

- Dear Mr Haseldine,

- Thank you for your letter dated 28th November 1992, and addressed to Dear Fundraisers. It has been passed onto me and I received it this morning.

- Thank you also for your ticket application form and for the cheque of £100 in support of One World Action. You will be pleased to know that your tickets for "Chaplin" will be sent to you in the post next week.

- Regarding your enclosed letter, I have consulted with One World Action as to how to proceed with your request. They feel that in view of the fact that there are many conflicting theories on the Lockerbie disaster, they cannot support the publication of your letter in their souvenir programme without first consulting the families of all the victims of Lockerbie. Unfortunately, this is simply not possible in the time we have. Our print deadline for advertisements is tomorrow, Friday 4th December.

- Hence, I shall not be pursuing this further and I shall not be contacting Jeannette Page of The Guardian "Letters" page.

- Thank you once again for your generous support and interest in One World Action.

- Yours sincerely,

- Caroline Hanson

- Julia Hobsbawm Associates

Finger of suspicion

On 4 December 1992, Patrick Haseldine faxed this reply (copying to Jeannette Page at The Guardian):

- Dear Caroline,

- Richard Attenborough's charity gala: 17 December 1992

- Many thanks for your reply dated 3 December. I fully appreciate the concern of One World Action about the printing in the souvenir programme of my letter published in The Guardian on 22 April 1992. Clearly the Lockerbie victims' families must not be offended in any way and that is my concern too.

- The letter in question is the latest of seven concerning Bernt Carlsson and Lockerbie that I sent to The Guardian for publication. As a result, I am in touch with Dr Jim Swire of UK Families Flight 103 (see following letter dated 7 August 1991 from The Guardian) and with Marina de Larracoechea of the US Hudson group of families. Their overriding aim is to discover the truth about Lockerbie and I am sure they would encourage One World Action to print any of my letters.

- Enclosed is the first letter published on 7 December 1989.[75] You may consider this less controversial and therefore more suitable to go into the souvenir programme.

- Yours sincerely,

De Beers: OWA benefactor

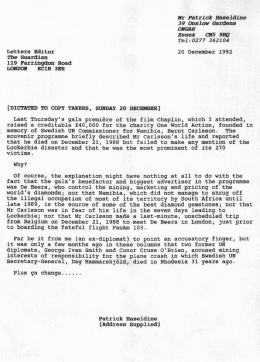

On 20 December 1992, Patrick Haseldine telephoned The Guardian and dictated to the 'copy takers' the following letter for publication:

- Last Thursday's gala premiere of the film "Chaplin", which I attended, raised a creditable £40,000 for the charity One World Action, founded in memory of Swedish UN Commissioner for Namibia, Bernt Carlsson. The souvenir programme briefly described Mr Carlsson's life and reported that he died on December 21, 1988 but failed to make any mention of the Lockerbie disaster and that he was the most prominent of its 270 victims.

- Why?

- Of course, the explanation might have nothing to do with the fact that the gala's benefactor and biggest advertiser in the programme was De Beers, who control the mining, marketing and pricing of the world's diamonds; nor that Namibia, which did not manage to shrug off the illegal occupation of most of its territory by South Africa until late 1989, is the source of some of the best diamond gemstones; nor that Mr Carlsson was in fear of his life in the seven days leading to Lockerbie; nor that Mr Carlsson made a last-minute, unscheduled trip from Belgium on December 21, 1988 to meet De Beers in London, just prior to boarding the fateful flight Pan Am 103.

- Far be it from me (an ex-diplomat) to point an accusatory finger, but it was only a few months ago in these columns that two former UN diplomats, George Ivan Smith and Conor Cruse O'Brien, accused mining interests of responsibility for the plane crash in which Swedish UN Secretary-General, Dag Hammarskjöld, died in Rhodesia 31 years ago.

- Plus ça change......

- Patrick Haseldine

- (Address Supplied)

Lockerbie's "polished gangsters"

On 28 January 2010, Gordon Brown published his theory entitled "Lockerbie: A Prime Suspect":

- With reference to the murder of United Nations Commissioner for Namibia, Bernt Carlsson, and 269 other innocent folk in the attack on Pan Am Flight 103 over Scotland in 1988, it would not be out of line to consider the De Beers/Anglo American Group a prime suspect as it had the Motive, Means and Opportunity to carry out such an attack.

- MOTIVE: With regards to motive, the Group had a pressing need:

- 1. to prevent an in-depth investigation of its decades-long illegal gem diamond mining operations in Namibia in breach of United Nations Decree No. 1 which Bernt Carlsson was about to conduct;

- 2. to prevent the United Nations Commissioner for Namibia from further uncovering and quantifying the secretive high-grading/overmining practice which the Group had embarked upon with the object of depleting Namibia’s more valuable gem diamond resources ahead of an internationally recognised independence settlement: an illegal practice which had been brought to public note through the findings of the Thirion Judicial Commission of Inquiry;

- 3. to hide from public scrutiny the human rights abuses and discriminatory employment practices the Group’s Namibian employees had been subjected to for more than 50 years;

- 4. to ward off a massive claim for damages the United Nations could legally have instituted against the Group on behalf of the people of Namibia;

- 5. to frustrate any action likely to threaten the Group’s dominant control of diamond mining in Namibia and prevent its lucrative concessions from being legally expropriated in the public interest and granted to a less controversial and more responsible mining company. This effectively would have ended the De Beers Diamond Cartel’s monopolistic control of the world diamond industry.

- MEANS: Through the Group’s established contacts and dealings with the CCB, CIA (through Maurice Tempelsman), BOSS and Executive Outcomes, the Group most certainly possessed the means to carry out such an attack. Breaking into Heathrow Airport’s luggage handling section would have posed little difficulty to any one of these organisations. There was money and expertise aplenty to carry out such an operation.

- OPPORTUNITY: There was more than adequate time to plan and execute this heinous criminal act as Bernt Carlsson’s movements and travel arrangements, dictated in part by De Beers in London, were known to the Group well in advance. It was the ideal crime as nobody would ever suspect Bernt Carlsson was the target and therefore no finger would ever point at De Beers/Anglo American. This cowardly attack was conveniently labelled the dastardly work of a terrorist organisation.[76]

Related Documents

| Title | Type | Publication date | Author(s) | Description |

|---|---|---|---|---|

| Document:De Beers to abandon cartel | Article | 30 May 2000 | Dan Atkinson | De Beers hit a high point in profit terms in the boom year 1989-90, but the following decade was to cost its shareholders billions of dollars. The break-up of the Soviet Union brought a flood of illicit diamonds on to the market, as did the civil war in Angola. In abandoning the CSO diamond cartel, Managing Director Gary Ralfe hopes to use De Beers' dominant position to persuade everyone in the industry to spend much more on marketing. |

| Document:How Mandela sold out blacks | open letter | 17 July 2012 | 'Youngster' | Bitter criticism of Nelson Mandela for capitulating to the apartheid regime and for failing to ensure that South Africa's mines, banks and minerals were "transferred to the ownership of the people as a whole" as required by the Freedom Charter. |

| Document:Pan Am Flight 103: It was the Uranium | article | 6 January 2014 | Patrick Haseldine | Following Bernt Carlsson's untimely death in the Lockerbie bombing, the UN Council for Namibia inexplicably dropped the case against Britain's URENCO for illegally importing yellowcake from the Rössing Uranium Mine in Namibia. |

References

- ↑ "Exploration and mining"

- ↑ "Anglo Ditching De Beers Is Hard Blow for Troubled Diamond Market"

- ↑ "The rise and fall of diamonds: the shattering of a brilliant illusion"

- ↑ "New Mining Target: Anglo American"

- ↑ "Glitter & Greed"

- ↑ "Ernest Oppenheimer and the Economic Development of Southern Africa"

- ↑ "Megrahi: You are my Jury"

- ↑ "South Africa Inc: The Oppenheimer Empire" (1987)

- ↑ "Oppenheimers leave the diamond race with $5bn sale"

- ↑ "The Rise and Fall of Diamonds"

- ↑ "The Economic Development of the British Overseas Empire"

- ↑ "Diamonds Gold and War"

- ↑ "The Autobiography of John Hays Hammond"

- ↑ "The Economic Development of the British Overseas Empire"

- ↑ "The Diamond Ring"

- ↑ "A Handbook of the Boer War With General Map of South Africa and 18 Sketch Maps and Plans"

- ↑ "Besieged by the Boers; a diary of life and events in Kimberley during the siege"

- ↑ "The Heartless Stone: A Journey Through the World of Diamonds, Deceit, and Desire"

- ↑ "De Beers S.A."

- ↑ "The Secret World of the Diamond Empire"

- ↑ "De Beers and Beyond: The History of the International Diamond Cartel"

- ↑ "Economics: Principles, Problems, and Policies"

- ↑ "Distribution outside the De Beers channel"

- ↑ "Betting on De Beers"

- ↑ "A Diamond Market No Longer Controlled By De Beers"

- ↑ "Anglo American gains controlling stake in De Beers"

- ↑ "Anglo American Ends Oppenheimers’ De Beers Dynasty With $5.1 Billion Deal"

- ↑ "De Beers to abandon cartel"

- ↑ "Debswana"

- ↑ "Namdeb"

- ↑ "De Beers Consolidated Mines"

- ↑ "Mining: Snap Lake Mine"

- ↑ "De Beers Canada"

- ↑ "Apr08_May08"

- ↑ "Reports The De Beers Group"

- ↑ "Anglo American agrees acquisition of Oppenheimer family interest in De Beers"

- ↑ "The Family of Companies"

- ↑ "De Beers ties up with luxury goods firm"

- ↑ "About De Beers the Diamond Authority"

- ↑ "Consumer demand"

- ↑ "Cinderella Dreams: The Allure of the Lavish Wedding"

- ↑ "'A Diamond Is Forever': How Four Words Changed an Industry"

- ↑ "Have you ever tried to sell a Diamond?"

- ↑ "In a show of power, women raise a glittery right hand"

- ↑ "AdFreak: Verizon does Big Red, De Beers ad parodies"

- ↑ "Forevermark"

- ↑ "The Rise and Fall of Diamonds (The Diamond Invention)"

- ↑ DeBeers Settlement "Gem diamond settlement"

- ↑ "De Beers pleads guilty in price fixing case"

- ↑ "De Beers Pleads to Price-Fixing: Firm Pays $10 million, Can Fully Reenter U.S."

- ↑ "Alrosa Purchasing Commitments – The De Beers Group"

- ↑ "DGIV decision appealed"

- ↑ "Targeting 'conflict diamonds' in Africa: Security Council seeks to enforce sanctions against rebels, arms suppliers"

- ↑ "Final Report of the UN Panel of Experts (the 'Fowler Report')"

- ↑ "De Beers: Come Clean to Be Clean"

- ↑ "De Beers Report to Stakeholders 2005/6 – Ethics, "Conflict and Instability"

- ↑ "FAQs The De Beers Group"

- ↑ "Kimberley Process Certification Scheme"

- ↑ "Kimberley Process Certification Scheme"

- ↑ "Best Practice Principles – The De Beers Group"

- ↑ "Diamonds are Forever in Botswana"

- ↑ "Bushmen"

- ↑ "De Beers battles with Survival"

- ↑ "Bushmen 'moved for diamonds'"

- ↑ "Botswana diamonds lose their sparkle"

- ↑ "Driven out of Eden"

- ↑ "Kalahari Bushmen win ancestral land case"

- ↑ "The Case of the Disappearing Diamonds" World In Action documentary film, 28 September 1987

- ↑ "Bernt Carlsson and The Case of the Disappearing Diamonds, Part 3"

- ↑ "The Dossier"

- ↑ "Historical background - UNCN"

- ↑ "Council for Namibia sues Netherlands over Namibia's natural resources"

- ↑ "The Thirion Report"

- ↑ "ANC as the fall-guys for Lockerbie bombing"

- ↑ "Finger of suspicion"

- ↑ "Lockerbie: A Prime Suspect"