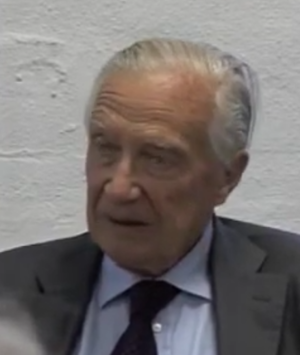

Martin Jacomb

( banker, businessman) | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||

| Born | 11 November 1929 | |||||||||||

| Died | 8 June 2024 (Age 94) | |||||||||||

| Nationality | British | |||||||||||

| Alma mater | • Eton College • Worcester College (Oxford) | |||||||||||

British banker who described "insider trading" as a "victimless crime". Attended the 1985 Bilderberg

| ||||||||||||

Sir Martin Wakefield Jacomb was a British banker who was a key adviser to the government on the 1984 privatisation of British Telecom.[1] He attended the 1985 Bilderberg meeting.

Education

Jacomb was born in Surrey on November 11 1929, the youngest of five children of a City wool broker. He was educated at Eton. He saw National Service as a second lieutenant in the Royal Artillery before going up to Worcester College, Oxford, to read law, and was called to the Bar by the Inner Temple in 1955.[2]

Career

He worked as a barrister for 13 years, among other jobs defending the zoo-keeper and gambler John Aspinall against an injunction brought by a neighbouring Kent farmer, restraining Aspinall from keeping bears and tigers.[2]

In 1968, he joined the corporate finance in the City of London, and became a vice-chairman of Kleinworts in 1976. In the early 1980s he moved from corporate finance to become head of the firm’s investment management division where, he was passed over for the chairmanship in 1983.[2]

He was as the leader of the Kleinwort team which advised the government on the privatisation of British Telecom and as a prominent thinker on City regulation and reform.[2]

At £3.9 billion, the first BT share sale was by far the largest ever attempted in London: during one meeting with the Chancellor, Nigel Lawson, Jacomb was the only City figure present who thought it could be done.[2]

Jacomb was once referred to as “the thinking man’s City grandee”. His early career at the Chancery bar taught him to extemporise on complex subjects with ease and elegance. An obituary in The Telegraph wrote that "Elaborate sentences delivered in slow, resonant tones combined with piercing blue eyes and a deceptively frail physique to create a mesmeric effect – especially on foreign bankers, who regarded him as something of a guru.[2]

At various times he was a member of the court of the Bank of England, an adviser to the US Federal Reserve, deputy chairman of Commercial Union and a director of Marks & Spencer, British Gas, RTZ, Christian Salvesen and The Telegraph. He sat on the boards of the Royal Opera House, the OUP, the National Heritage Memorial Fund, and was Chancellor of Buckingham University. He was knighted in 1985.[2]

He moved to Barclays as deputy chairman in 1985, prior to chairing its new securities and merchant banking arm, BZW. After retiring from BZW in 1991, he became chairman of Postel Investment Management, the City’s largest pension fund management institution, and of the British Council. [3]

On leaving Postel in 1994 he became chairman of the Prudential Corporation until 2000; he was also chairman of Delta, a metals conglomerate, and Share Plc, a retail stockbroking business; his last major chairmanship, from 2003, was of the Canary Wharf property company.

Opinions

Martin Jacomb described "insider trading" as a "victimless crime".[4]

Jacomb rarely involved himself in public controversy, but his views on topics such as the single European currency (which he believed could not be made to work without political union) or the explosive growth of the “derivatives” markets, were given prominence in the financial press. He voted Remain in the EU referendum, “but only because the EU will collapse unless reformed, and I would like the UK to lead the reformation”.[2]

Publications

- 2009 - Grumpy Old Bankers[5]

Event Participated in

| Event | Start | End | Location(s) | Description |

|---|---|---|---|---|

| Bilderberg/1985 | 10 May 1985 | 12 May 1985 | New York US Arrowwood of Westchester Rye Brook | The 33rd Bilderberg, held in Canada |

References

- ↑ https://www.csfi.org/2021-10-21-sir-martin-jacomb-explainer

- ↑ Jump up to: a b c d e f g h https://www.telegraph.co.uk/obituaries/2024/06/13/sir-martin-jacomb-guru-city-grandee-bt-prudential/

- ↑ https://www.thetimes.com/uk/obituaries/article/sir-martin-jacomb-obituary-banker-who-was-one-of-architects-of-the-big-bang-vc0cjklgn

- ↑ http://us.ft.com/ftgateway/superpage.ft?news_id=fto070920071224153705&page=2

- ↑ https://www.goodreads.com/author/show/2942039.Martin_Jacomb