Difference between revisions of "Cryptocurrency"

(→Centralization and abuse: +pic) |

m (→Abuse) |

||

| Line 37: | Line 37: | ||

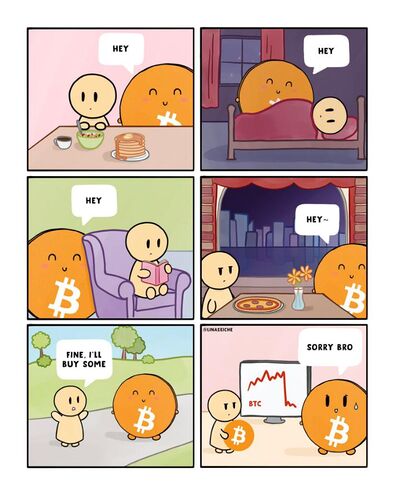

[[image:Btc-pumpndump.jpg|right|400px|thumbnail|Pump-and-dump schemes involve propaganda]] | [[image:Btc-pumpndump.jpg|right|400px|thumbnail|Pump-and-dump schemes involve propaganda]] | ||

The power to abuse such a relative simple accounting system comes with: | The power to abuse such a relative simple accounting system comes with: | ||

| − | *control of the money supply (if not fixed or regulated by mining rules) | + | *control of the money supply (if not fixed or regulated by mining rules) |

| − | *[[oligarchy]], i.e over-simplified Prove-of-Stake (PoS) [[consensus algorithm]]s | + | *undemocratic control of the '''[[source code]]''' |

| + | *[[oligarchy]], i.e over-simplified Prove-of-Stake (PoS) [[consensus algorithm]]s - these are preferred by {{ccm}} as ''energy friendly'' | ||

*arbitrary fees and exchange rates | *arbitrary fees and exchange rates | ||

| − | *luring users to require a login at a server, i.e. give away power over their funds voluntarily, by not owning fully their secret keys | + | *luring users to require a login at a server, i.e. give away power over their funds voluntarily, by not owning fully their secret keys. The {{ccm}} goes on to report these cases as ''stolen tokens'' |

| − | *abusing [[pump-and-dump]] schemes powered by [[CFD]]s. Users are mislead to believe betting on some | + | *abusing [[pump-and-dump]] schemes powered by [[CFD]]s. Users are mislead to believe betting on some token equals "buying" or "owning" it. Casinos market themself as "exchanges". |

*smart contracts: scripts my be executed before any transaction to check against arbitrary rules; set - in the worst case - by a central un-legitimized authority. Skript may force (digital ID) authorization and link addresses to external databases processed at runtime. The aimed for total control is expressed by BIS CEO [[Agustín Carstens]] in his quote below. | *smart contracts: scripts my be executed before any transaction to check against arbitrary rules; set - in the worst case - by a central un-legitimized authority. Skript may force (digital ID) authorization and link addresses to external databases processed at runtime. The aimed for total control is expressed by BIS CEO [[Agustín Carstens]] in his quote below. | ||

Revision as of 18:48, 19 March 2022

(currency, p2p) | |

|---|---|

| Interest of | • Daniel Bruno • Agustín Carstens • Dollar Vigilante • Nikolai Mushegian |

| Digital currencies with computer generated security protection. | |

The BIS and other central banks have announced, that CBDC will be introduced until 2025. As the lack of understanding of our current monetary system has led to exploitation of the 99% by the 1%, this page will set out to explain the mechanics of digital currencies in the simplest terms possible.

Cryptocurrency, sometimes called crypto-currency or (confusingly) just "crypto", is a form of currency that exists digitally or virtually and uses cryptography to secure transactions.

Contents

General components of digital currencies

- A "book" where entries and changes are stored corresponding to addresses (much like in a file system); entries may consist of

- constant values (i.e. past transactions)

- variable values and executables (i.e. scripts, smart contracts, NFTs)

- A network of computers owned by one or more authorities with server status (called nodes), i.e. powerful machines with high up-time and fast interconnection. Nodes may sit in one room or be spread all over the globe. Some nodes are required to have 100% up-time.

- A consensus protocol in case the nodes disagree about entries which should be written to the "book"

- A public key algorithm. To enter contracts a secret key is needed for authentification

Software components

A general idea is the mathematical expression of a one-way street, which means that the result of a calculation can be published safely; even if the exact algorithm is known, it is not feasible (today) to reverse engineer the components (secrets) which were used as input to derive the output. This concept is found in both fingerprinting (hashes, or checksums) and public key algorithms.

The metaphor is "Alice" forging both a lock and a key in such a way that the lock does not reveal the shape of the key. She may then use a fingerprint (hash) of the lock (pubkey) as marker or address and submit this address to nodes who agree if it is a valid type. Once included in the big "book" (blockchain), "Bob" may propose to add value to the address. To withdraw, however, or subtract from the address Alices' (secret) key is needed. She "owns" the address. Note that the making of the address takes place off-chain, and even off-line, at the home of Alice (with a slow home computer) and Alice does not depend in any way on other more powerful entities to make use of the blockchain at this stage.

Consensus must be reached by the nodes before finalizing the blockchain in a solid state. The censensus algorithm is a central part of the validation of contracts (transactions). The number of units (if designed as currency) may or may not be tied to the validation process. The number of units (if designed as currency) may or may not be constant or limited. Often, a finite number of units is chosen.

As a general rule mining refers to increasing the miner's account in exchange for up-time, i.e. contribution to the whole network. To encourage up-time, mining is made as slow as possible - but also wasting CPU cycles while solving tricky mathematical problems. Other incentives for up-time include fees ("gas"). Higher transaction fees encourages faster execution. Fees are nevertheless voluntary (in theory).

Centralization and abuse

Cryptocurrencies other than CBDC don't generally have a central issuing or regulating authority, instead using a decentralized system, e.g. a p2p network to store the blockchain. However, there are many varieties that are centralized - with the promise to be "decentralized" later, but controlled by a single authority.

As mentioned above the average user does not want to (Moxie), or is not able to, run a server (node) 24/7. But does that mean, that there is demand for centralization and platformization? 99 percent of hits returned by any search engine suggests that there is no other possibility. For example, many results give the impression that owning an address with a secret key ("having a wallet") requires running a certain piece of software. This is false.

The secret key is all that is needed to manage funds and it may well be written on a piece of paper ("paper wallet"). It can be created off-line and off-chain, without any third party needed. Equally a transaction does not require parties to be online[citation needed]. It can be performed on paper and handed in later.

Abuse

The power to abuse such a relative simple accounting system comes with:

- control of the money supply (if not fixed or regulated by mining rules)

- undemocratic control of the source code

- oligarchy, i.e over-simplified Prove-of-Stake (PoS) consensus algorithms - these are preferred by commercially-controlled media as energy friendly

- arbitrary fees and exchange rates

- luring users to require a login at a server, i.e. give away power over their funds voluntarily, by not owning fully their secret keys. The commercially-controlled media goes on to report these cases as stolen tokens

- abusing pump-and-dump schemes powered by CFDs. Users are mislead to believe betting on some token equals "buying" or "owning" it. Casinos market themself as "exchanges".

- smart contracts: scripts my be executed before any transaction to check against arbitrary rules; set - in the worst case - by a central un-legitimized authority. Skript may force (digital ID) authorization and link addresses to external databases processed at runtime. The aimed for total control is expressed by BIS CEO Agustín Carstens in his quote below.

Skript is used to increase privacy and usability in the Lightening network and in atomic swap contracts. If abused, smart contracts may be disastrous.

Quotes from WP and Bloomberg

"In cryptocurrency networks, mining is a validation of transactions. For this effort, successful miners obtain new cryptocurrency as a reward. The reward decreases transaction fees by creating a complementary incentive to contribute to the processing power of the network"[1]. (WP)

"Individual coin ownership records are stored in a digital ledger, which is a computerized database using strong cryptography to secure transaction records, to control the creation of additional coins, and to verify the transfer of coin ownership. Not reliant on any central authority, such as a government or bank, to uphold or maintain it draws people who favour anonymity. Bitcoin is pseudonymous rather than anonymous in that the cryptocurrency within a wallet is not tied to people, but rather to one or more specific keys (or "addresses")".[2] (Bloomberg)

Blame

Cryptocurrency mining was blamed by commercially-controlled media for supply chain shortages.[3]

Ban

China banned cryptocurrencies in 2021, while introducing its own CBDC at the same time.[citation needed] The WEF surmised cryptocurrencies were facilitating capital flight from China's markets, bypassing conventional restrictions.[4]

Examples

| Page name | Description |

|---|---|

| Bitcoin | A cryptocurrency |

| CBDC | Blockchain hosted replacement for cash, run by central banks |

| Lightening network | Bitcoin micropayment protocoll |

Related Quotations

| Page | Quote | Author | Date |

|---|---|---|---|

| CBDC | “We intend to establish the equivalence with cash and there is a huge difference there, for example in cash we don’t know who is using a 100 dollar bill today ... the key difference with the CBDC is that the central bank will have absolute control on the rules and regulations that will determine the use regarding that expression of central bank liability and also we will have the technology to enforce that.” | Agustín Carstens | October 2020 |

| Whitney Webb | “Bitcoiners should pay close attention to these developments as the DOJ in particular has attempted to paint bitcoin as the payment of choice for well-known terror groups like ISIS and al-Qaida, signaling that the working group proposed by this bill will likely seek to specifically target bitcoin. Adding to this concern is the fact that a slew of recent mainstream media reports — which cite Treasury and FinCEN officials, DOJ officials and CIA analysts — have claimed specifically that “terrorists are turning to bitcoin, and they’re learning fast”, that bitcoin is the “new frontier in terror financing”, and that “bitcoin is helping terrorists secretly fund their deadly attacks”. Even the prominent military think tank RAND Corporation has argued that “bitcoin and the dark web” are the newest terrorist threat.” | Whitney Webb | September 2023 |

Related Documents

| Title | Type | Publication date | Author(s) | Description |

|---|---|---|---|---|

| Declaration of Currency Independence | declaration | May 2021 | John McAfee | The main author, John McAfee, died mysteriously in jail the next month. |

| Declaration of Monetary Independence | declaration | 2021 | Mark Maraia Mike Hobart | |

| Document:Silicon Valley’s Trump supporters are dicing with the death of democracy | Article | 4 August 2024 | John Naughton | Speaking to a Christian convention in Florida the other day, Donald Trump said: “Get out and vote. Just this time. You won’t have to do it any more. Four more years, you know what: it’ll be fixed, it’ll be fine. You won’t have to vote any more, my beautiful Christians.” |

References

- ↑ https://en.wikipedia.org/wiki/Cryptocurrency#Mining

- ↑ https://web.archive.org/web/20181219093844/https://www.bloomberg.com/news/articles/2018-09-13/mystery-of-the-2-billion-bitcoin-whale-that-fueled-a-selloff

- ↑ https://www.economist.com/graphic-detail/2021/06/19/crypto-miners-are-probably-to-blame-for-the-graphics-chip-shortage

- ↑ https://www.weforum.org/agenda/2022/01/what-s-behind-china-s-cryptocurrency-ban/