"Public-Private Partnership"

(Asset stripping, Corruption) | |

|---|---|

| |

| Type | economy |

| Interest of | • Behavioural Insights Team • Boston Consulting Group • Tim Evans • Richard Hatchett • Robert Kadlec • McKinsey & Company • Stephen Redd • J. Martin Taylor |

| An economic concept invented to loot public assets. | |

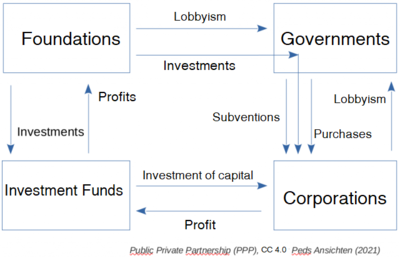

Public-private "partnerships" is an arrangement where the public purse, sometimes in exchange for less up-front expenses, let a private company build and run infrastructure or services projects, often on a monopoly basis and with a publicly guaranteed income flow.

The scheme has been used across the board in formerly public services, especially infrastructure, but also health services, policing and military contracts. The contracts are often confidential, making assessments of their profitability impossible for outsiders.

Contents

Investors

Privately financed public infrastructure offers investors two means of profit making: as projects and as assets. Physical infrastructure projects like bridges, highways, and water treatment facilities provide stable and predictable revenue since they monopolize the role of provider and deliverer of that service to particular communities. The monopoly position is then guaranteed by multi-decade government contracts that often contain anti-competition clauses. And as a financial asset, public infrastructure brings in high returns for low risk. Mark Florian, the head of North American infrastructure banking at Goldman Sachs, summarizes the eagerness of investors to have government set up and lock in P3 projects: “there’s a lot of value trapped in public assets”[1]

Public

For the public, the result is normally disastrous — public services and infrastructure maintenance is consistently more expensive under Public-Private "Partnership" schemes.

Government

Public-Private "Partnerships" is a way of stealthily privatizing assets, and of permanently depriving governments of long-term income.

Another advantage with these "partnerships" is the ability use accounting tricks, where the state's payment obligations, which might be fixed for decades in the future, are not counted towards its debt ratio.

Other problems

These projects are often made in secret by the executive, without parliamentary oversight, under the mantle of commercial confidentiality.

The investor might go bankrupt in the first few years, and the public sector has to assume the obligations of the investor and start again at a loss.

The investor increases the rent by way of additional claims though loopholes, well above the initially agreed level.

The original projects estimates are often beautified to push the project through, for monopoly contract periods then to be extended to 30, 40 and 50 years to make good the income guarantee.

These failures (or successes, depending on which side of the table you sit) are often cause by the confidentiality of the contracts, private arbitration, high transaction and consultant costs, and the relevant consultants' affiliation to the organized PPP lobby.

Social control

- Full article: Social control

- Full article: Social control

Obviously, who controls vital infrastructure of a society (i.e water, electricity, health care, public transport, internet and media, etc.) also controls its people by denying or allowing access to these resources.

External links

- Water Makes Money a documentary about corrupt privatization of water, which occurs "everyday, all over the world".[2]

Examples

| Page name | Description |

|---|---|

| Business for Inclusive Growth | A partnership between the OECD and major corporations from across the globe. |

| CARB-X | A globalpartnership focused on antibacterial products, financed by the super-spooky BARDA and the Gates Foundation. |

| Chan Zuckerberg Initiative | |

| Global Alliance for Vaccines and Immunization | Global Vaccine organizer - a kind of "health NATO". The Gates Foundation describes Gavi as a "partner in vaccine market shaping". |

| Innovative Medicines Initiative | Big Pharma capture of EU policy making and budgets |

Related Quotation

| Page | Quote | Author |

|---|---|---|

| Theodore Dalrymple | “The British government has managed to spend approximately $50 billion on a system for testing and tracing cases of COVID-19. So far, the average citizen has been tested five times. Yet mysteriously, the British mortality rate is either above, or very similar to, that of countries that have tested and traced much less often. A parliamentary commission reported that there was no evidence that the whole system had had any beneficial effect whatever. This was a very hasty and naive conclusion. It assumed, for example, that the real object of the system was to prevent illness and save lives. But if one puts aside this facile prejudice, one may come to the conclusion that it was an enormous success, for—in now traditional fashion—it shoveled enormous quantities of public money into private pockets, no doubt seriously enriching large numbers of people. If one assumes that the purpose of the expenditure was to create or reward a clientele class, not only does everything become clear, but it changes one’s opinion as to whether or not the whole thing was a success—in its own terms, of course.” | Theodore Dalrymple |