Difference between revisions of "2008 Financial Crisis"

(update) |

(integrating Global Financial Crisis) |

||

| Line 2: | Line 2: | ||

|wikipedia=https://en.wikipedia.org/wiki/Financial_crisis_of_2007%E2%80%932008 | |wikipedia=https://en.wikipedia.org/wiki/Financial_crisis_of_2007%E2%80%932008 | ||

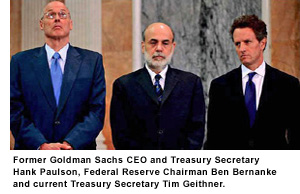

|image=Economic-death-squad-paulson-bernanke-geithner.jpg | |image=Economic-death-squad-paulson-bernanke-geithner.jpg | ||

| − | |||

|constitutes= fraud, banking crisis | |constitutes= fraud, banking crisis | ||

| + | |image_width=350px | ||

| + | |start=2007 | ||

}} | }} | ||

'''2008 Financial Crisis''' was systemic event that shook the global financial system during the period from mid-[[2007]] to late-[[2008]]. | '''2008 Financial Crisis''' was systemic event that shook the global financial system during the period from mid-[[2007]] to late-[[2008]]. | ||

| Line 10: | Line 11: | ||

This event saw the vertical integration of many financial institutions by [[JP Morgan Chase]] as many failing financial institutions were bought up by the company.<ref>https://www.usatoday.com/story/money/economy/2018/09/14/jamie-dimon-jp-morgan-memo-actions-financial-crisis/1304253002/</ref> | This event saw the vertical integration of many financial institutions by [[JP Morgan Chase]] as many failing financial institutions were bought up by the company.<ref>https://www.usatoday.com/story/money/economy/2018/09/14/jamie-dimon-jp-morgan-memo-actions-financial-crisis/1304253002/</ref> | ||

| + | |||

| + | ==Official narrative== | ||

| + | Oh, naughty [[Lehman Brothers]] - well that just shows that some banks are "[[too big to fail]]". Anyway, this whole thing is history - check the [[Wikipedia]] page title: 2007-2008(!) ... we are beyond it now ... | ||

==Catalyst== | ==Catalyst== | ||

| + | [[file:Global Financial Crisis.jpg|right|thumb|800px|A trader has a bad day in 2007/8]] | ||

The event is considered to have been caused primarily by the foreclosure of thousands of [[subprime mortgage loans]] due the aggressive predatory lending strategies of many financial institutions, including the government backed institutions [[Fannie Mae]] and [[Freddie Mac]]. This was coupled with the wide scale [[deregulation]] of so-called "derivative" financial instruments that were used by companies such as [[JP Morgan Chase]] to "bet" against the potential failure of mortgage assets that they were deemed "likely to fail", and thereby benefit from any potential default on these assets.<ref>https://www.thebalance.com/what-caused-2008-global-financial-crisis-3306176</ref><ref>https://www.latimes.com/business/la-fi-financial-crisis-timeline-20180909-htmlstory.html</ref> | The event is considered to have been caused primarily by the foreclosure of thousands of [[subprime mortgage loans]] due the aggressive predatory lending strategies of many financial institutions, including the government backed institutions [[Fannie Mae]] and [[Freddie Mac]]. This was coupled with the wide scale [[deregulation]] of so-called "derivative" financial instruments that were used by companies such as [[JP Morgan Chase]] to "bet" against the potential failure of mortgage assets that they were deemed "likely to fail", and thereby benefit from any potential default on these assets.<ref>https://www.thebalance.com/what-caused-2008-global-financial-crisis-3306176</ref><ref>https://www.latimes.com/business/la-fi-financial-crisis-timeline-20180909-htmlstory.html</ref> | ||

At the peak of the crisis, from November to December of [[2008]]; [[Bilderberger]] [[Robert Rubin]] pocketed $126 million in cash and stock options during his one month tenure at [[Citigroup]] as CEO. <ref>https://www.theguardian.com/world/2014/apr/19/wall-street-deregulation-clinton-advisers-obama</ref> | At the peak of the crisis, from November to December of [[2008]]; [[Bilderberger]] [[Robert Rubin]] pocketed $126 million in cash and stock options during his one month tenure at [[Citigroup]] as CEO. <ref>https://www.theguardian.com/world/2014/apr/19/wall-street-deregulation-clinton-advisers-obama</ref> | ||

| + | |||

| + | |||

| + | |||

| + | {{SMWDocs}} | ||

| + | ==References== | ||

| + | {{reflist}} | ||

| + | {{Stub}} | ||

| + | |||

| + | |||

| + | |||

| + | |||

{{SMWDocs}} | {{SMWDocs}} | ||

Revision as of 18:41, 29 March 2021

| |

| Date | 2007 - Present |

|---|---|

| Interest of | Jörg Asmussen |

2008 Financial Crisis was systemic event that shook the global financial system during the period from mid-2007 to late-2008.

Many financial institutions (including Goldman Sachs, Bear Stearns & Lehman Brothers) that had been responsible for precipitating the crisis were labeled as "too big to fail" by Treasury Secretary Henry Paulson[1] and were provided emergency funding in the billions of dollars by American tax payers via the Emergency Economic Stabilization Act of 2008.

This event saw the vertical integration of many financial institutions by JP Morgan Chase as many failing financial institutions were bought up by the company.[2]

Contents

Official narrative

Oh, naughty Lehman Brothers - well that just shows that some banks are "too big to fail". Anyway, this whole thing is history - check the Wikipedia page title: 2007-2008(!) ... we are beyond it now ...

Catalyst

The event is considered to have been caused primarily by the foreclosure of thousands of subprime mortgage loans due the aggressive predatory lending strategies of many financial institutions, including the government backed institutions Fannie Mae and Freddie Mac. This was coupled with the wide scale deregulation of so-called "derivative" financial instruments that were used by companies such as JP Morgan Chase to "bet" against the potential failure of mortgage assets that they were deemed "likely to fail", and thereby benefit from any potential default on these assets.[3][4]

At the peak of the crisis, from November to December of 2008; Bilderberger Robert Rubin pocketed $126 million in cash and stock options during his one month tenure at Citigroup as CEO. [5]

Related Document

| Title | Type | Publication date | Author(s) | Description |

|---|---|---|---|---|

| Document:Our Spartan Future: Neo-feudalism | Book excerpt | 2011 | Rosa Koire | Rosa Koire's assessment why policies lead to undesirable outcomes. |

References

- ↑ https://www.sfgate.com/news/article/Feds-take-control-of-Fannie-Mae-Freddie-Mac-3270123.php

- ↑ https://www.usatoday.com/story/money/economy/2018/09/14/jamie-dimon-jp-morgan-memo-actions-financial-crisis/1304253002/

- ↑ https://www.thebalance.com/what-caused-2008-global-financial-crisis-3306176

- ↑ https://www.latimes.com/business/la-fi-financial-crisis-timeline-20180909-htmlstory.html

- ↑ https://www.theguardian.com/world/2014/apr/19/wall-street-deregulation-clinton-advisers-obama

Related Document

| Title | Type | Publication date | Author(s) | Description |

|---|---|---|---|---|

| Document:Our Spartan Future: Neo-feudalism | Book excerpt | 2011 | Rosa Koire | Rosa Koire's assessment why policies lead to undesirable outcomes. |