Difference between revisions of "Money/Creation"

m (Robin moved page US/Federal Reserve/The Money Creation Process to US/Federal ReseMoney Creation: shorter title) |

m (Text replacement - "mainstream media" to "corporate media") |

||

| (13 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

{{concept | {{concept | ||

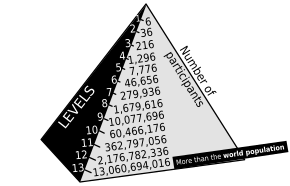

| − | |image= | + | |image=Pyramid scheme.svg.png |

|image_width=300px | |image_width=300px | ||

| − | |description= | + | |description=The money creation process is not only a [[Third rail topic]], off limits to {{ccm}}. It is also subject to a wide ranging and extensive misdirection campaign. |

|glossary= | |glossary= | ||

| + | |constitutes=Third rail topic, Disaster | ||

|website=http://www.robinupton.com/people/WizardsOfMoney/ | |website=http://www.robinupton.com/people/WizardsOfMoney/ | ||

|wikipedia=https://en.wikipedia.org/wiki/Money_creation | |wikipedia=https://en.wikipedia.org/wiki/Money_creation | ||

| + | |interests=Petrodollar | ||

}} | }} | ||

| − | + | Nowadays, almost all '''money is created''' ''ex nihilis'', i.e. "out of thin air". It is not backed by [[gold]] or other such physical object, but simply entered into a ledger on computers. | |

| − | The following is a summary of a series of articles written by an anonymous investment | + | <hr/> |

| + | The following is a summary of a series of articles written by an anonymous investment banking consultant. In it's own words the [[Wizards of Money]] will take a critical look at the mechanics of the capital and debt markets, who makes the critical decisions that drive them, and how these markets then effect everybody’s lives. | ||

==Exactly How Does Money Get Created?== | ==Exactly How Does Money Get Created?== | ||

| − | + | {{QB|Lets talk briefly about the actual mechanics of money creation. Money creation happens in two main ways; First the creation of base money, which is mostly physical currency notes, created by the Federal Reserve. The second money creation process involves checking account or deposit money created by the commercial banks, and which makes up most of the money supply.}} | |

| − | {{ | ||

===High Powered Money=== | ===High Powered Money=== | ||

| − | + | {{QB|Base money, also called high powered money, is created when the Federal Reserve performs what are known as Open Market Operations. In this process the Federal Reserve injects money by buying Government Securities, which then become debt owed by the government (that is the American Taxpayer) to the Federal Reserve.}} | |

| − | {{ | ||

Government Securities are [[IOU]]'s, promises to payback the principal + interest at a given time, auctioned at the open market. | Government Securities are [[IOU]]'s, promises to payback the principal + interest at a given time, auctioned at the open market. | ||

| Line 22: | Line 23: | ||

{{Q|And where does the Federal Reserve get this money to buy the government securities? Well, it just makes it up "out of thin air". The Federal Reserve has no budget, quite simply because it doesn’t need one – it invents money whenever it needs it.}} | {{Q|And where does the Federal Reserve get this money to buy the government securities? Well, it just makes it up "out of thin air". The Federal Reserve has no budget, quite simply because it doesn’t need one – it invents money whenever it needs it.}} | ||

| − | + | Formally speaking the FED has added securities to its assets, which it has paid for by creating a '''liability on itself''' in the form of bank reserve balances or Federal Reserve Notes. Bank reserve balances (FED accounts for public banks) and Federal Reserve Notes together form 'high powered money'. | |

| − | {{Q|In fact, almost all money we come by has its basis in high powered money that the Federal Reserve invented at some time in the past. Most of this base money is currency in the form of Federal Reserve Notes. The Federal Reserve then creates a spurious "liability" on its balance sheet called Federal Reserve Notes outstanding, and in return gets an asset in the form of government securities, '''which the public must repay through the efforts of real work'''. Every time the Federal Reserve creates or extinguishes base money the financial press and other | + | {{Q|In fact, almost all money we come by has its basis in high powered money that the Federal Reserve invented at some time in the past. Most of this base money is currency in the form of Federal Reserve Notes. The Federal Reserve then creates a spurious "liability" on its balance sheet called Federal Reserve Notes outstanding, and in return gets an asset in the form of government securities, '''which the public must repay through the efforts of real work'''. Every time the Federal Reserve creates or extinguishes base money the financial press and other corporate media reports it as a Greenspan interest rate announcement. This is not technically correct but it does sound more palatable than saying that the Federal Reserve just made some money up or just made some money disappear.}} |

====The Federal Open Market Committee (FOMC)==== | ====The Federal Open Market Committee (FOMC)==== | ||

{{FA|The Federal Open Market Committee}} | {{FA|The Federal Open Market Committee}} | ||

| + | |||

| + | [[image:Money_Creation.jpg|left|300px|thumbnail|The Wizards of Money]] | ||

| + | The most important function of the Federal Open Market Committee (FOMC) is to increase or decrease the money supply. It does this by the deliberate and judicious buying and selling of securities on behalf of the twelve Federal Reserve banks. | ||

| − | + | The F.O.M.C. can, without informing the government, the public, or the banks (its meetings are held in secret), increase or decrease the reserves of the banks. | |

| − | |||

| − | |||

| − | |||

| − | The F.O.M.C. can, without informing the government, the public, or the banks (its meetings are held in | ||

| − | secret), increase or decrease the reserves of the banks. | ||

For example, if it wants the money supply to increase, it will buy government securities. If it wants the money supply to decrease, it will sell securities. | For example, if it wants the money supply to increase, it will buy government securities. If it wants the money supply to decrease, it will sell securities. | ||

| − | The Federal Reserve banks can buy an unlimited amount of securities because they do not have to pay for | + | The Federal Reserve banks can buy an unlimited amount of securities because they do not have to pay for the securities with anything. They pay for the securities by making bookkeeping entries in the member banks' reserve accounts. |

| − | the securities with anything. They pay for the securities by making bookkeeping entries in the member | ||

| − | banks' reserve accounts. | ||

| − | It is reasonable to conclude that the Federal Reserve System through the operations of the F.O.M.C. is in a | + | It is reasonable to conclude that the [[Federal Reserve System]] through the operations of the F.O.M.C. is in a position to control, to a large extent, the economic conditions of the country. |

| − | position to control, to a large extent, the economic conditions of the country. | ||

====An Example==== | ====An Example==== | ||

| Line 50: | Line 46: | ||

In May 1975 the government paid out a rebate check of up to $200 to each individual who paid 1974 U.S. income taxes. And in June 1975, the government paid $50 to every recipient of Social Security Insurance, Supplemental Security Income or Railroad Retirement annuity or pension payments. | In May 1975 the government paid out a rebate check of up to $200 to each individual who paid 1974 U.S. income taxes. And in June 1975, the government paid $50 to every recipient of Social Security Insurance, Supplemental Security Income or Railroad Retirement annuity or pension payments. | ||

| − | The government officials paid out that money in order to increase the money supply in circulation with the | + | The government officials paid out that money in order to increase the money supply in circulation with the hope that these actions would increase the buying and selling of goods and services and thus create more jobs. One side effect of that action was that the government officials had to incur additional interest-bearing debts in order to make those payments. But what happened? |

| − | hope that these actions would increase the buying and selling of goods and services and thus create more jobs. One side effect of that action was that the government officials had to incur additional interest-bearing debts in order to make those payments. But what happened? | ||

| − | About July 1, 1975, the prime interest rates began to increase. Between July 1 and August 8, 1975, the | + | About July 1, 1975, the prime interest rates began to increase. Between July 1 and August 8, 1975, the prime interest rates increased about one percent, from 6 & 3/4% on July 1 to 7 & 3/4% on August 8. |

| − | prime interest rates increased about one percent, from 6 & 3/4% on July 1 to 7 & 3/4% on August 8. | ||

| − | The F.O.M.C. buys and sells securities in secret. It does not tell the public the amount of securities it buys | + | The F.O.M.C. buys and sells securities in secret. It does not tell the public the amount of securities it buys and sells until weeks later. However, the people who understand what makes the interest rates go up or down can deduce what actions the F.O.M.C. has taken. |

| − | and sells until weeks later. However, the people who understand what makes the interest rates go up or | ||

| − | down can deduce what actions the F.O.M.C. has taken. | ||

| − | When the interest rates increased in July 1975, we could conclude that the F.O.M.C. offered for sale on the | + | When the interest rates increased in July 1975, we could conclude that the F.O.M.C. offered for sale on the open market enough securities to cause the price of the securities to decline. That act caused the interest rates to rise. |

| − | open market enough securities to cause the price of the securities to decline. That act caused the interest | ||

| − | rates to rise. | ||

| − | We thus witnessed a situation in which government officials incurred an extra interest-bearing debt to | + | We thus witnessed a situation in which government officials incurred an extra interest-bearing debt to increase the money supply in circulation and at almost the same time the F.O.M.C. took action to decrease the money supply. |

| − | increase the money supply in circulation and at almost the same time the F.O.M.C. took action to decrease | ||

| − | the money supply. | ||

===Bank Credit=== | ===Bank Credit=== | ||

| Line 91: | Line 79: | ||

==The Zero Sum Game== | ==The Zero Sum Game== | ||

{{Q| | {{Q| | ||

| − | What is often overlooked about the monetary system, particularly by advocates of the "trickle down" hypothesis, is that it is a ZERO SUM GAME, because our money is entirely debt based. The more of a positive net money balance I have, the more of a negative balance someone else has. I can put my positive balance to work earning more money, while I either sit around and do nothing, or go and work for more money. '''So the most likely situation for a positive balance person is that their positive balance will keep growing. Also, in the zero sum game, this means that someone else’s balance gets more negative. The negative sum person would be unlikely to get a loan to start their own business, and so would have to go work for someone that already has money.''' Under current wage structures and interest rates for "high risk" customers it would be difficult for many negative balance people to ever get to a positive balance position no matter how hard they work. They have the added disadvantage that they can’t put a positive balance to work earning more money. '''Most likely their balances will get more negative, while the people that already have money will get more money to balance out the zero sum game.''' | + | What is often overlooked about the monetary system, particularly by advocates of the "trickle down" hypothesis, is that it is a [[Zero sum game|ZERO SUM GAME]], because our money is entirely debt based. The more of a positive net money balance I have, the more of a negative balance someone else has. I can put my positive balance to work earning more money, while I either sit around and do nothing, or go and work for more money. '''So the most likely situation for a positive balance person is that their positive balance will keep growing. Also, in the zero sum game, this means that someone else’s balance gets more negative. The negative sum person would be unlikely to get a loan to start their own business, and so would have to go work for someone that already has money.''' Under current wage structures and interest rates for "high risk" customers it would be difficult for many negative balance people to ever get to a positive balance position no matter how hard they work. They have the added disadvantage that they can’t put a positive balance to work earning more money. '''Most likely their balances will get more negative, while the people that already have money will get more money to balance out the zero sum game.''' |

With positive money balances always earning a positive return on capital, combined with no requirement for redistribution of wealth, which is implicitly prohibited by neo-liberal policy because it eases such governmental intervention, the results are clear. '''The rich will keep getting richer and the poor will keep getting poorer,''' and the more interest bearing debt-money you "invest" in developing nations the worse (not better) the situation gets. '''Those that believe that the "trickle down" effect will result from investment in poorer (more negative balance) countries and neighborhoods demonstrate a very poor understanding of the monetary system. In fact they believe in something that cannot possibly materialize,''' and is evidenced by the consequences of investment in developing nations. }} | With positive money balances always earning a positive return on capital, combined with no requirement for redistribution of wealth, which is implicitly prohibited by neo-liberal policy because it eases such governmental intervention, the results are clear. '''The rich will keep getting richer and the poor will keep getting poorer,''' and the more interest bearing debt-money you "invest" in developing nations the worse (not better) the situation gets. '''Those that believe that the "trickle down" effect will result from investment in poorer (more negative balance) countries and neighborhoods demonstrate a very poor understanding of the monetary system. In fact they believe in something that cannot possibly materialize,''' and is evidenced by the consequences of investment in developing nations. }} | ||

| − | Generally speaking the zero sum game promotes conflict. Conflicting parties need money to stand competition (in the extreme case: fight a war) in order to maintain their positive balance position. | + | ===Promotion of Violence and Conflict=== |

| + | {{SMWQ | ||

| + | |text=Generally speaking the [[zero sum game]] promotes conflict. Conflicting parties need money to stand competition (in the extreme case: fight a war) in order to maintain their positive balance position. The only regulatory principle to limit the promotion of violence in all shapes and colors is the monetary monopoly's [http://www.altruists.org/f285 need to manage risk.] Fatally, the risk taken by banks is distorted by the doctrine that ''the monetary monopoly as a whole may not fail''. This so called '''[[Moral Hazard]]''' caused by public bailouts encourages investments in exploitation and [[war]]. What really trickles down is [[violence]], not wealth. | ||

| + | |subjects=zero sum game, Money, violence, Fractional-reserve banking, New Age | ||

| + | |date= | ||

| + | |authors='Smithy' | ||

| + | |source_name=Wizards of Money | ||

| + | |source_URL= | ||

| + | |source_details= | ||

| + | }} | ||

| + | |||

| + | {{SMWDocs}} | ||

| − | + | ==References== | |

| − | + | {{Reflist}} | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | {{ | ||

Latest revision as of 18:56, 14 December 2023

(Third rail topic, “Disaster”) | |

|---|---|

| |

| Interest of | • Bronson Cutting • Benjamin Franklin • G. Edward Griffin • Hang The Bankers • Pierre Jovanovic • Nikolai Mushegian • Brandon Smith |

| The money creation process is not only a Third rail topic, off limits to commercially-controlled media. It is also subject to a wide ranging and extensive misdirection campaign. | |

Nowadays, almost all money is created ex nihilis, i.e. "out of thin air". It is not backed by gold or other such physical object, but simply entered into a ledger on computers.

The following is a summary of a series of articles written by an anonymous investment banking consultant. In it's own words the Wizards of Money will take a critical look at the mechanics of the capital and debt markets, who makes the critical decisions that drive them, and how these markets then effect everybody’s lives.

Contents

Exactly How Does Money Get Created?

Lets talk briefly about the actual mechanics of money creation. Money creation happens in two main ways; First the creation of base money, which is mostly physical currency notes, created by the Federal Reserve. The second money creation process involves checking account or deposit money created by the commercial banks, and which makes up most of the money supply.

High Powered Money

Base money, also called high powered money, is created when the Federal Reserve performs what are known as Open Market Operations. In this process the Federal Reserve injects money by buying Government Securities, which then become debt owed by the government (that is the American Taxpayer) to the Federal Reserve.

Government Securities are IOU's, promises to payback the principal + interest at a given time, auctioned at the open market.

Formally speaking the FED has added securities to its assets, which it has paid for by creating a liability on itself in the form of bank reserve balances or Federal Reserve Notes. Bank reserve balances (FED accounts for public banks) and Federal Reserve Notes together form 'high powered money'.

The Federal Open Market Committee (FOMC)

- Full article: The Federal Open Market Committee

- Full article: The Federal Open Market Committee

The most important function of the Federal Open Market Committee (FOMC) is to increase or decrease the money supply. It does this by the deliberate and judicious buying and selling of securities on behalf of the twelve Federal Reserve banks.

The F.O.M.C. can, without informing the government, the public, or the banks (its meetings are held in secret), increase or decrease the reserves of the banks.

For example, if it wants the money supply to increase, it will buy government securities. If it wants the money supply to decrease, it will sell securities.

The Federal Reserve banks can buy an unlimited amount of securities because they do not have to pay for the securities with anything. They pay for the securities by making bookkeeping entries in the member banks' reserve accounts.

It is reasonable to conclude that the Federal Reserve System through the operations of the F.O.M.C. is in a position to control, to a large extent, the economic conditions of the country.

An Example

In May 1975 the government paid out a rebate check of up to $200 to each individual who paid 1974 U.S. income taxes. And in June 1975, the government paid $50 to every recipient of Social Security Insurance, Supplemental Security Income or Railroad Retirement annuity or pension payments.

The government officials paid out that money in order to increase the money supply in circulation with the hope that these actions would increase the buying and selling of goods and services and thus create more jobs. One side effect of that action was that the government officials had to incur additional interest-bearing debts in order to make those payments. But what happened?

About July 1, 1975, the prime interest rates began to increase. Between July 1 and August 8, 1975, the prime interest rates increased about one percent, from 6 & 3/4% on July 1 to 7 & 3/4% on August 8.

The F.O.M.C. buys and sells securities in secret. It does not tell the public the amount of securities it buys and sells until weeks later. However, the people who understand what makes the interest rates go up or down can deduce what actions the F.O.M.C. has taken.

When the interest rates increased in July 1975, we could conclude that the F.O.M.C. offered for sale on the open market enough securities to cause the price of the securities to decline. That act caused the interest rates to rise.

We thus witnessed a situation in which government officials incurred an extra interest-bearing debt to increase the money supply in circulation and at almost the same time the F.O.M.C. took action to decrease the money supply.

Bank Credit

For What Purposes Money Is Created

Decisions on making new money will be based on whether a lender can repay and how much interest the lender can bring in, which is what creates bank profits. This means most money will be created to lend to people that already have lots of previously created money, and lots of advantages in life. Disadvantaged people will often be denied access to the money creating process, except under exploitative circumstances which are likely to see high interest rates and/or ultimate possession of their assets and resources by the bank. Alternatively the more disadvantaged will have to seek money from non-bank entities that have already accumulated lots of money, and this often also leads to exploitation.

What this also means is that money is NOT created for things most desired by society as a whole. In fact it is often created for exactly the things that society does not want at all. This includes projects that involve excessive destruction of natural resources like logging, building power plants, mining, and so forth, because the bank realizes that such projects are likely to bring back the money that will pay off the loans. It is also interesting to note that money is almost NEVER created for the purpose of providing public goods, such as education and healthcare, for such services will not pay the bank back. Rather these services depend on recycled money through the tax system. Hence it is not surprising that we have reached a situation where monetary value and social value are inversely correlated. By this I mean that a good or service with a high monetary value in the private property markets generally has a low social value. Conversely high social value goods and services generally return a low monetary value. This is illustrated in the example where public goods providers such as teachers are some of the lowest paid workers, yet currency trading is perhaps the most lucrative profession there is, and has also become one of the most socially destructive. It is reasonable to expect that this situation would be largely reversed by taking social factors and public input into consideration at the point of money origination.

It is clear that origination of money at commercial banks is undemocratic and so encourages the creation of money (or loans) for many undesirable activities. But often overlooked is the unchecked power of the Fed, the creator of Base Money. One of the best reminders of this power is then Federal Reserve Governor Paul Volcker's hike in interest rates in 1979 that triggered the Latin America debt crisis. This came at tremendous cost to the people of Latin American countries. While the activities of OPEC, the commercial banks and various dictators, played a major role in laying the foundations of this crisis, the final push was decided at one committee meeting conducted behind closed doors. The FOMC meetings have never been open to public input or scrutiny. While summaries of meetings are posted almost immediately, the full transcripts of FOMC are not even available until 5 YEARS after the event!

It's important to be concerned that the money origination process is not subject to democratic accountability. Many of these problems could be remedied if the public had more input into the decisions surrounding the origination of money. This requires an entirely different paradigm for thinking about money than we have today. It is a very complex problem and there are no simple answers. But at the very least it should be high on the list of topics for public debate. In addition, once you understand the process for creating money out of thin air, you begin to see that what banks and the Federal Reserve do is not so difficult after all.

Some hope for better money is starting to materialize from the local and alternative monetary systems such as LETS and Ithaca Hours.The Zero Sum Game

What is often overlooked about the monetary system, particularly by advocates of the "trickle down" hypothesis, is that it is a ZERO SUM GAME, because our money is entirely debt based. The more of a positive net money balance I have, the more of a negative balance someone else has. I can put my positive balance to work earning more money, while I either sit around and do nothing, or go and work for more money. So the most likely situation for a positive balance person is that their positive balance will keep growing. Also, in the zero sum game, this means that someone else’s balance gets more negative. The negative sum person would be unlikely to get a loan to start their own business, and so would have to go work for someone that already has money. Under current wage structures and interest rates for "high risk" customers it would be difficult for many negative balance people to ever get to a positive balance position no matter how hard they work. They have the added disadvantage that they can’t put a positive balance to work earning more money. Most likely their balances will get more negative, while the people that already have money will get more money to balance out the zero sum game.

With positive money balances always earning a positive return on capital, combined with no requirement for redistribution of wealth, which is implicitly prohibited by neo-liberal policy because it eases such governmental intervention, the results are clear. The rich will keep getting richer and the poor will keep getting poorer, and the more interest bearing debt-money you "invest" in developing nations the worse (not better) the situation gets. Those that believe that the "trickle down" effect will result from investment in poorer (more negative balance) countries and neighborhoods demonstrate a very poor understanding of the monetary system. In fact they believe in something that cannot possibly materialize, and is evidenced by the consequences of investment in developing nations.Promotion of Violence and Conflict

“Generally speaking the zero sum game promotes conflict. Conflicting parties need money to stand competition (in the extreme case: fight a war) in order to maintain their positive balance position. The only regulatory principle to limit the promotion of violence in all shapes and colors is the monetary monopoly's need to manage risk. Fatally, the risk taken by banks is distorted by the doctrine that the monetary monopoly as a whole may not fail. This so called Moral Hazard caused by public bailouts encourages investments in exploitation and war. What really trickles down is violence, not wealth.”

'Smithy' [1]

An example

| Page name | Description |

|---|---|

| Petrodollar | The selling of the world's oil in U.S. dollars has been the backbone of U.S. dollar hegemony since the U.S. unilaterally terminated the rights of foreign central banks to convert dollars to gold in 1971. |

Related Quotations

| Page | Quote | Author | Date |

|---|---|---|---|

| Bronson Cutting | “The fight against the abolition of the credit power of private banks will be a savage one, for their power as a unit is without equal in the country. Knowing this is why I think back to the events of March 4, 1933, with a sick heart. For then, with even the bankers thinking the whole economic system had crashed to ruin, the nationalization of banks by President Roosevelt could have been accomplished without a word of protest. It was President Roosevelt’s great mistake. Now the bankers will make a mighty struggle.” | Bronson Cutting | |

| Mervyn King | “Of all the many ways of organizing banking, the worst is the one we have today. Change is, I believe, inevitable. The question is only whether we can think our way through to a better outcome before the next generation is damaged by a future and bigger crisis.” | Mervyn King | |

| Money | “To say that a state cannot pursue its aims, because there is no money, is like saying that an engineer cannot build roads, because there are no kilometers.” | Ezra Pound | |

| J. P. Morgan | “... [credit] is an evidence of banking, but it [credit] is not the money itself. Money is gold, and nothing else.” | J.P. Morgan & Co. J. P. Morgan | |

| Petrodollar | “Money supply and debt have exploded in the absence of gold convertibility [...] Today's money is not backed by gold. It is now backed by nothing at all, except our trust in the monetary system.” | Smithy | 2003 |

| Social change | “Until the control of the issue of currency and credit is restored to government and recognized as its most conspicuous and sacred responsibility, all talk of the sovereignty of Parliament and of democracy is idle and futile.” | William Lyon Mackenzie King | 1935 |

Related Documents

| Title | Type | Publication date | Author(s) | Description |

|---|---|---|---|---|

| Document:The Occult Technology of Power | letter | June 1974 | Anonymous | A letter and lecture transcripts addressed to a mature son from his father. Their purpose is to prepare the son for his taking the reins of a financial business empire. |

| File:The Federal Reserve conspiracy by Antony C Sutton.pdf | book | Antony Sutton | Historical perspectives on the money trust including critique of Karl Marx |