Anti-Tax Avoidance Directive

| |

On 28 January 2016, the Commission presented its proposal for the European Union's Anti-Tax Avoidance Directive as part of the Anti-Tax Avoidance Package.[1] On 20 June 2016 the Council adopted the Directive (EU) 2016/1164 laying down rules against tax avoidance practices that directly affect the functioning of the internal market.[2]

In order to provide for a comprehensive framework of anti-abuse measures the Commission presented its proposal on 25th October 2016, to complement the existing rule on hybrid mismatches.[3] The rule on hybrid mismatches aims to prevent companies from exploiting national mismatches to avoid taxation.

In addition to the proposal the Commission also published its Staff Working Document.[4]

The Anti-Tax Avoidance Directive contains five legally-binding anti-abuse measures, which all Member States should apply against common forms of aggressive tax planning.

Member States should apply these measures as from 1 January 2019.

Contents

Anti-avoidance measures

ATAD creates a minimum level of protection against corporate tax avoidance throughout the EU, while ensuring a fairer and more stable environment for businesses.

The anti-avoidance measures in the Anti-Tax Avoidance Directive other than the rule on hybrid mismatches, are:

- Controlled foreign company (CFC) rule: to deter profit shifting to a low/no tax country.

- Switchover rule: to prevent double non-taxation of certain income.

- Exit taxation: to prevent companies from avoiding tax when re-locating assets.

- Interest limitation: to discourage artificial debt arrangements designed to minimise taxes.

- General anti-abuse rule: to counteract aggressive tax planning when other rules don’t apply.[5]

UK implementation

As part of the draft Finance Bill clauses published by the United Kingdom (UK) Government on 6 July 2018, a number of changes have been proposed to ensure that the provisions of the European Union (EU) Anti-Tax Avoidance Directive (ATAD) are transposed into UK tax law as required. Although the UK is scheduled to leave the EU on 29 March 2019 and the Withdrawal Agreement has not yet been finalised, it is expected that the UK will need to comply with the ATAD requirements at least throughout any transition period agreed. Consequently, the UK is proposing to implement any changes that would be required to be brought in by the ATAD by 1 January 2019 (when the UK will still be within the EU) or 1 January 2020 (which is expected to be within the transition period). Requirements that must be implemented by a later date are still under review.

The ATAD sets out a requirement for Member States to adopt certain anti-avoidance provisions to facilitate the creation of a ”level playing field” across the EU. The UK Government has assessed the ATAD requirements against the existing tax legislation and has concluded that changes are required in the following areas:

- Controlled foreign company rules, which need to be applied with effect from 1 January 2019

- Exit taxation rules (in particular, the deferral mechanisms applicable in certain circumstances), which need to be applied from 1 January 2020

- Certain anti-hybrid rules, which need to be applied from 1 January 2020 (other ”reverse hybrid” changes are required by 1 January 2022 and are still under review)

- The consultation on the draft legislation will run until 31 August 2018 and measures are intended to be included in what will become Finance Act 2019.[6]

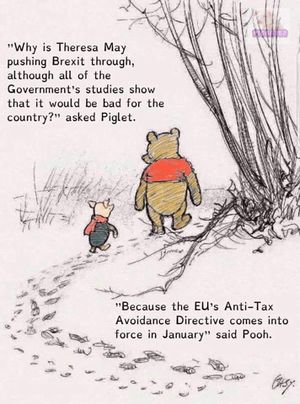

Brexiteer fantasy

As from January 2019, just as the Brexit deadline looms, all EU member states will have to apply the Anti-Tax Avoidance Directive (ATAD). It’s an EU law designed to tackle businesses shirking their tax-paying responsibilities.

The likes of Nigel Farage, Jacob Rees-Mogg and a host of wealthy Brexit donors are unlikely to warm to ATAD. It fact, it might be one of reasons why some Brexiteers are hell-bent on pushing for the hardest Brexit possible.

The directive seeks to tackle the thriving culture of corporate tax avoidance. For example, consider the scenario in which an EU company shifts profits to a related company in a low-tax country reducing the tax paid on these profits: under ATAD, a company could still do this, but the profits will be taxable at EU rates. Another situation is where EU businesses developing a new product move it to a low tax country to avoid paying larger taxes on the profits once it is developed. Thanks to ATAD this tactic won’t work as member states can levy tax on the product before it is moved.

Even with ATAD, you might argue companies – through their nifty lawyers – will find new loopholes to avoid tax, right? The EU thought of that: ATAD provides a general anti-abuse rule to counteract these regimes where national laws have failed to address them. There are many other measures in ATAD which you will no doubt be inspired to research. But before you do that, you will hear people air grievances that this Directive is another example of how the EU hates business or that it is another instance of Brussels encroaching on our sovereignty.

Dealing with the first allegation, anti-tax avoidance laws are not developed to harm businesses. Their objective is to ensure companies play ball in a competitive market which means paying their fair share of tax. Flowing from this, in a globalised market, agreeing a set of rules to encourage fair trade is hardly an encroachment upon sovereignty. It is an acceptance that the world today sometimes requires countries to come together and agree on things for mutual benefit.

Britain becoming a low-tax haven economy on the shores of Europe is a Brexiteer fantasy – and ATAD compliance poses a direct threat to that. But a low-tax haven for the rich will thrash the public services upon which the vast majority of us rely on and deepen inequalities in modern day Britain.

Most of us can agree tax is far from ideal but a means to very vital end. If the likes of Google or Amazon were going to be put out of business by following the ATAD one could see the logic in rallying against it. But we know these major corporations will be just fine; meanwhile our schools and hospitals are left in crisis.[7]

Related Documents

| Title | Type | Publication date | Author(s) | Description |

|---|---|---|---|---|

| Document:The Real Reason Theresa May’s Brexit Has Failed | Article | 2 March 2019 | T. J. Coles | So, the choice faced by ordinary British people is between a neoliberal EU supported by millionaires like Kenneth Clarke or an ultra-neoliberal Brexit supported by multimillionaires like Jacob Rees-Mogg. Meanwhile, ordinary working-class people pay the price for these elite games, as usual. |

| Document:Was EU Tax Evasion Regulation The Reason For The Brexit Referendum | Blog post | 26 September 2017 | Josh Hamilton | The EU's new anti-abuse measures coming into force in 2019 would tighten up restrictions on UK-based intermediaries that take part in off-shoring and tax avoidance, of which Britain is a global leader |

References

- ↑ "Anti-Tax Avoidance Package"

- ↑ "Council Directive (EU) 2016/1164 of 12 July 2016 laying down rules against tax avoidance practices that directly affect the functioning of the internal market"

- ↑ "Council Directive amending Directive (EU) 2016/1164 as regards hybrid mismatches with third countries"

- ↑ "Commission Staff Working Document"

- ↑ "The Anti-Tax Avoidance Directive"

- ↑ "UK takes steps to implement EU Anti-Tax Avoidance Directive"

- ↑ "Is this the real reason why Farage and Rees-Mogg want a speedy Brexit?"