Difference between revisions of "Insider trading"

(basic formatting) |

m (Destubbing the page with best example) |

||

| Line 1: | Line 1: | ||

{{Concept | {{Concept | ||

|description = Trading for your own benefit with knowledge only few have. | |description = Trading for your own benefit with knowledge only few have. | ||

| − | |image = | + | |image = File:Ratio3x2 1800.jpg |

| + | |constitutes=Crime, White-collar crime | ||

|image_caption = | |image_caption = | ||

|image_credit = | |image_credit = | ||

| Line 10: | Line 11: | ||

}} | }} | ||

| − | '''Insider trading''' refers to the buying or selling of a security on the basis of information that is not available to the public.<ref>https://www.sec.gov/fast-answers/answersinsiderhtm.html</ref><ref>https://www.investopedia.com/terms/i/insidertrading.asp</ref><ref>https://economictimes.indiatimes.com/definition/insider-trading</ref> | + | '''Insider trading''' refers to the buying or selling of a security (often also cared shares on the stock market) on the basis of information that is not available to the public.<ref>https://www.sec.gov/fast-answers/answersinsiderhtm.html</ref><ref>https://www.investopedia.com/terms/i/insidertrading.asp</ref><ref>https://economictimes.indiatimes.com/definition/insider-trading</ref> |

==Friends in high places== | ==Friends in high places== | ||

| Line 16: | Line 17: | ||

<blockquote>"Under the guidance of an attorney representing [[Tyson Foods]], [[Hillary Clinton]] made a $98,540 profit from a $1,000 initial investment in less than one year trading commodity futures. While $98,540 may not seem like much money relative to the Clinton family's wealth today, it exceeded Bill and Hillary's combined annual income at the time"..."In Hillary Clinton's case, her $1,000 initial investment was well below the $12,000 deposit required by the Chicago Mercantile Exchange for the first trades she executed. So not only did Hillary make an extraordinary profit for a novice investor, she did so without following the rules applied to less well-connected traders." </blockquote> | <blockquote>"Under the guidance of an attorney representing [[Tyson Foods]], [[Hillary Clinton]] made a $98,540 profit from a $1,000 initial investment in less than one year trading commodity futures. While $98,540 may not seem like much money relative to the Clinton family's wealth today, it exceeded Bill and Hillary's combined annual income at the time"..."In Hillary Clinton's case, her $1,000 initial investment was well below the $12,000 deposit required by the Chicago Mercantile Exchange for the first trades she executed. So not only did Hillary make an extraordinary profit for a novice investor, she did so without following the rules applied to less well-connected traders." </blockquote> | ||

| + | |||

| + | ==9-11== | ||

| + | {{FA|9-11/Insider trading}} | ||

| + | ===9/11 Commission Report=== | ||

| + | The [[9/11 Commission Report]] mentioned the name of [[Buzzy Krongard]], former executive director of the [[CIA]], stating:<ref>[http://www.fromthewilderness.com/free/ww3/10_09_01_krongard.html Suppressed Details of Criminal Insider Trading Lead Directly Into The CIA's Highest Ranks]</ref> | ||

| + | {{QB|"A single U.S.-based institutional investor with no conceivable ties to [[al Qaeda]] purchased 95 percent of the [[United Airlines|UAL]] puts on September 6 (2001) as part of a strategy that also included buying 115,000 shares of [[American Airlines|American]] on September 10. Similarly, much of the seemingly suspicious trading on September 10 was traced to a specific U.S.-based options trading newsletter... which recommended these trades."<ref>Norton, W.W. (2004). 9/11 Commission Report. p. 499.</ref>}} | ||

| + | The implied conclusion is that having "no conceivable ties to al Qaeda" the investor could not have had foreknowledge of the attacks. | ||

| + | |||

| + | ===Almost Irrefutable Proof?=== | ||

| + | The [[German Central bank]] studied the possibility of [[insider trading]]. According to German central bank president [[Ernst Welteke]], the German researchers found “almost irrefutable proof of insider trading”.<ref>http://www.historycommons.org/context.jsp?item=aearly0901german#aearly0901german</ref> | ||

| + | The [[Washington Post]] reported on 23rd September [[2001]]:<ref>William Drozdiak, “‘Insider trading’ by terrorists is suspected in Europe”, Miami Herald, September 24, 2001, http://web.archive.org/web/20011109160700/www.miami.com/herald/special/news/worldtrade/digdocs/099922.htm</ref><ref>https://www.washingtonpost.com/archive/politics/2001/09/23/germans-probe-likely-links-between-profits-and-terrorists/1c42fc2d-c092-416c-8594-1e6758b5d86c/ saved at [https://web.archive.org/web/20170827115538/https://www.washingtonpost.com/archive/politics/2001/09/23/germans-probe-likely-links-between-profits-and-terrorists/1c42fc2d-c092-416c-8594-1e6758b5d86c/ Archive.org] saved at [https://archive.ph/wpz5p Archive.is]</ref> | ||

| + | {{QB|Welteke said his researchers came across what he considers almost irrefutable proof of insider trading as recently as Thursday, but he refused to release details pending further consultations with regulators in other countries. | ||

| + | "What we found makes us sure that people connected to the terrorists must have been trying to profit from this tragedy," he said at a meeting of European finance ministers and central bankers. | ||

| + | Besides massive short selling of airlines and insurance stocks, Welteke said "there was a fundamentally inexplicable rise" in world oil prices just before the attacks that suggest certain groups or people were buying oil contracts that were then sold for a much higher price. He said German researchers also detected movements in gold markets "which need explaining." | ||

| + | "If you look at the movements in markets before and after the attacks, it really makes your brow furrow," Welteke said. "It is extremely difficult to really verify it, but we are confident we will be able to pinpoint the source in at least one or two cases."}} | ||

| + | |||

{{SMWDocs}} | {{SMWDocs}} | ||

==References== | ==References== | ||

{{reflist}} | {{reflist}} | ||

| − | |||

Revision as of 17:38, 3 November 2023

(Crime, White-collar crime) | |

|---|---|

| |

| Type | criminal |

| Trading for your own benefit with knowledge only few have. | |

Insider trading refers to the buying or selling of a security (often also cared shares on the stock market) on the basis of information that is not available to the public.[1][2][3]

Contents

Friends in high places

Regarding the Clinton family's trading of commodity futures in 1978 and 1979, Marc Joffe of The Fiscal Times wrote:[4][5]

"Under the guidance of an attorney representing Tyson Foods, Hillary Clinton made a $98,540 profit from a $1,000 initial investment in less than one year trading commodity futures. While $98,540 may not seem like much money relative to the Clinton family's wealth today, it exceeded Bill and Hillary's combined annual income at the time"..."In Hillary Clinton's case, her $1,000 initial investment was well below the $12,000 deposit required by the Chicago Mercantile Exchange for the first trades she executed. So not only did Hillary make an extraordinary profit for a novice investor, she did so without following the rules applied to less well-connected traders."

9-11

- Full article: 9-11/Insider trading

- Full article: 9-11/Insider trading

9/11 Commission Report

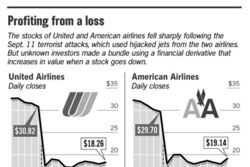

The 9/11 Commission Report mentioned the name of Buzzy Krongard, former executive director of the CIA, stating:[6]

"A single U.S.-based institutional investor with no conceivable ties to al Qaeda purchased 95 percent of the UAL puts on September 6 (2001) as part of a strategy that also included buying 115,000 shares of American on September 10. Similarly, much of the seemingly suspicious trading on September 10 was traced to a specific U.S.-based options trading newsletter... which recommended these trades."[7]

The implied conclusion is that having "no conceivable ties to al Qaeda" the investor could not have had foreknowledge of the attacks.

Almost Irrefutable Proof?

The German Central bank studied the possibility of insider trading. According to German central bank president Ernst Welteke, the German researchers found “almost irrefutable proof of insider trading”.[8] The Washington Post reported on 23rd September 2001:[9][10]

Welteke said his researchers came across what he considers almost irrefutable proof of insider trading as recently as Thursday, but he refused to release details pending further consultations with regulators in other countries.

"What we found makes us sure that people connected to the terrorists must have been trying to profit from this tragedy," he said at a meeting of European finance ministers and central bankers. Besides massive short selling of airlines and insurance stocks, Welteke said "there was a fundamentally inexplicable rise" in world oil prices just before the attacks that suggest certain groups or people were buying oil contracts that were then sold for a much higher price. He said German researchers also detected movements in gold markets "which need explaining."

"If you look at the movements in markets before and after the attacks, it really makes your brow furrow," Welteke said. "It is extremely difficult to really verify it, but we are confident we will be able to pinpoint the source in at least one or two cases."

An example

| Page name | Description |

|---|---|

| 9-11/Insider Trading | A mound of evidence points to insider trading. However, the 9/11 Commission decided not to investigate the matter and the SEC destroyed important records. |

References

- ↑ https://www.sec.gov/fast-answers/answersinsiderhtm.html

- ↑ https://www.investopedia.com/terms/i/insidertrading.asp

- ↑ https://economictimes.indiatimes.com/definition/insider-trading

- ↑ https://www.thefiscaltimes.com/Columns/2016/02/02/Why-37-Year-Old-Clinton-Financial-Scandal-Still-Relevant saved at Archive.org saved at Archive.is

- ↑ https://www.businessinsider.com/clinton-futures-scandal-still-relevant-today-2016-2

- ↑ Suppressed Details of Criminal Insider Trading Lead Directly Into The CIA's Highest Ranks

- ↑ Norton, W.W. (2004). 9/11 Commission Report. p. 499.

- ↑ http://www.historycommons.org/context.jsp?item=aearly0901german#aearly0901german

- ↑ William Drozdiak, “‘Insider trading’ by terrorists is suspected in Europe”, Miami Herald, September 24, 2001, http://web.archive.org/web/20011109160700/www.miami.com/herald/special/news/worldtrade/digdocs/099922.htm

- ↑ https://www.washingtonpost.com/archive/politics/2001/09/23/germans-probe-likely-links-between-profits-and-terrorists/1c42fc2d-c092-416c-8594-1e6758b5d86c/ saved at Archive.org saved at Archive.is