Difference between revisions of "9-11/Insider Trading"

(stub) |

(destruction of evidence) |

||

| Line 1: | Line 1: | ||

| − | There | + | {{event |

| + | |description=A mound of evidence points to insider trading. However, the SEC | ||

| + | }} | ||

| + | [[image:9-11_insider_trading.jpg|right|thumb|400px]] | ||

| + | There ''was'' a lot of evidence of trading in the run up to [[9/11]] consistent with foreknowledge. David Callahan – executive editor of SmartCEO – submitted a [[Freedom of Information Act]] request to the [[SEC]] regarding the pre-9/11 put options. He was told: "We have been advised that the potentially responsive records have been destroyed."<ref>http://www.washingtonsblog.com/2010/06/sec-government-destroyed-documents-regarding-pre-911-put-options.html</ref> | ||

| − | The [[9/11 Commission]] | + | The [[9/11 Commission]] concluded: |

| − | {{SMWDocs}}{{ | + | {{QB|Highly publicized allegations of insider trading in advance of 9/11 generally rest on reports of unusual pre-9/11 trading activity in companies whose stock plummeted after the attacks. Some unusual trading did in fact occur, but each such trade proved to have an innocuous explanation. For example, the volume of put options- investments that pay off only when a stock drops in price-surged in the parent companies of United Airlines on September 6 and American Airlines on September 10-highly suspicious trading on its face. Yet, further investigation has revealed that the trading had no connection with 9/11. A single U.S.-based institutional investor with no conceivable ties to al Qaeda purchased 95 percent of the UAL puts on September 6 as part of a trading strategy that also included buying 115,000 shares of American on September 10. Similarly, much of the seemingly suspicious trading in American on September 10 was traced to a specific U.S.-based options trading newsletter, faxed to its subscribers on Sunday, September 9, which recommended these trades. These examples typify the evidence examined by the investigation. The SEC and the FBI, aided by other agencies and the securities industry, devoted enormous resources to investigating this issue, including securing the cooperation of many foreign governments. These investigators have found that the apparently suspicious consistently proved innocuous. Joseph Cella interview (Sept. 16, 2003; May 7, 2004; May 10-11, 2004); FBI briefing (Aug. 15, 2003); SEC memo, Division of Enforcement to SEC Chair and Commissioners, “Pre-September 11, 2001 Trading Review,” May 15, 2002; Ken Breen interview (Apr. 23, 2004); Ed G. interview (Feb. 3, 2004).<br/> |

| + | Footnote 130 to chapter 5 of the official [[9/11 Commission]] report}} | ||

| + | |||

| + | <ref>http://www.washingtonsblog.com/2010/06/sec-government-destroyed-documents-regarding-pre-911-put-options.html</ref> | ||

| + | {{SMWDocs}} | ||

| + | ==References== | ||

| + | {{reflist}} | ||

Revision as of 10:10, 13 April 2014

| Interest of | Lars Schall |

|---|---|

| Description | A mound of evidence points to insider trading. However, the SEC |

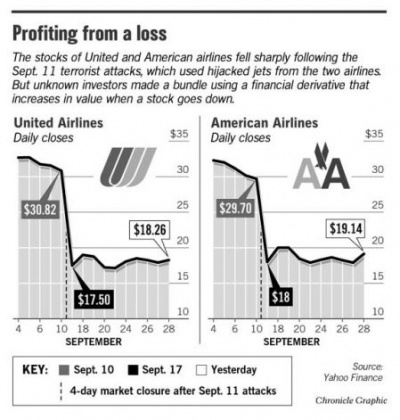

There was a lot of evidence of trading in the run up to 9/11 consistent with foreknowledge. David Callahan – executive editor of SmartCEO – submitted a Freedom of Information Act request to the SEC regarding the pre-9/11 put options. He was told: "We have been advised that the potentially responsive records have been destroyed."[1]

The 9/11 Commission concluded:

Highly publicized allegations of insider trading in advance of 9/11 generally rest on reports of unusual pre-9/11 trading activity in companies whose stock plummeted after the attacks. Some unusual trading did in fact occur, but each such trade proved to have an innocuous explanation. For example, the volume of put options- investments that pay off only when a stock drops in price-surged in the parent companies of United Airlines on September 6 and American Airlines on September 10-highly suspicious trading on its face. Yet, further investigation has revealed that the trading had no connection with 9/11. A single U.S.-based institutional investor with no conceivable ties to al Qaeda purchased 95 percent of the UAL puts on September 6 as part of a trading strategy that also included buying 115,000 shares of American on September 10. Similarly, much of the seemingly suspicious trading in American on September 10 was traced to a specific U.S.-based options trading newsletter, faxed to its subscribers on Sunday, September 9, which recommended these trades. These examples typify the evidence examined by the investigation. The SEC and the FBI, aided by other agencies and the securities industry, devoted enormous resources to investigating this issue, including securing the cooperation of many foreign governments. These investigators have found that the apparently suspicious consistently proved innocuous. Joseph Cella interview (Sept. 16, 2003; May 7, 2004; May 10-11, 2004); FBI briefing (Aug. 15, 2003); SEC memo, Division of Enforcement to SEC Chair and Commissioners, “Pre-September 11, 2001 Trading Review,” May 15, 2002; Ken Breen interview (Apr. 23, 2004); Ed G. interview (Feb. 3, 2004).

Footnote 130 to chapter 5 of the official 9/11 Commission report

Related Quotation

| Page | Quote | Author | Date |

|---|---|---|---|

| 2021 | “Speaking of shorting stock did they ever find out who shorted those airlines stocks just before 9/11? Just Asking. You Wallstreet fucks are worried about GameStop but there are deep questions that get brought up. Enjoy.” | Immortal Technique | January 2021 |

Related Documents

| Title | Type | Publication date | Author(s) | Description |

|---|---|---|---|---|

| Document:9/11 Insider Trading | article | 18 November 2010 | Kevin Ryan | Evidence for Informed Trading based on foreknowledge of the 9-11 attacks |

| File:911 Abnormal Trading.pdf | paper | 13 April 2010 | Wing-Keung Wong Kweehong Teh Howard E. Thompson | Evidence of foreknowledge about the 9-11 terrorist attacks in the form of financial trading irregularities |