Difference between revisions of "Financial Crimes Enforcement Network"

m (Robin moved page FinCEN to Financial Crimes Enforcement Network) |

(structure and origins) |

||

| Line 8: | Line 8: | ||

==Official Narrative== | ==Official Narrative== | ||

The Financial Crimes Enforcement Network (FinCEN) is a bureau of the [[United States Department of the Treasury]] that collects and analyzes information about financial transactions in order to combat domestic and international [[money laundering]], [[terrorist financing]] and other financial crimes. | The Financial Crimes Enforcement Network (FinCEN) is a bureau of the [[United States Department of the Treasury]] that collects and analyzes information about financial transactions in order to combat domestic and international [[money laundering]], [[terrorist financing]] and other financial crimes. | ||

| + | ==History== | ||

| + | In 2001, the [[USA PATRIOT Act]] required the [[US Secretary of the Treasury]], [[Paul O'Neill]], to create a secure network for the transmission of information to enforce the relevant regulations. FinCEN’s regulations under Section 314(a) enable federal law enforcement agencies, through FinCEN, to reach out to more than 45,000 points of contact at more than 27,000 financial institutions to locate accounts and transactions of persons that may be involved in terrorist financing and/or money laundering. A web interface allows the person(s) designated in §314(a)(3)(A) to register and transmit information to FinCEN.{{cn}} | ||

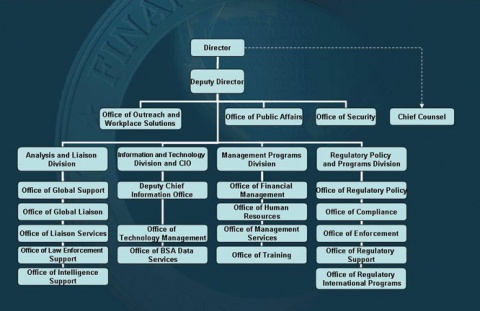

| + | ==Structure== | ||

| + | [[image:FinCEN_organization.jpg|480px|thumbnail]] | ||

{{SMWDocs}} | {{SMWDocs}} | ||

==References== | ==References== | ||

{{reflist}} | {{reflist}} | ||

{{Stub}} | {{Stub}} | ||

Revision as of 18:20, 22 August 2016

| |

| Parent organization | US/Department/The Treasury |

| Interests | money laundering, terrorist financing, financial crimes |

Official Narrative

The Financial Crimes Enforcement Network (FinCEN) is a bureau of the United States Department of the Treasury that collects and analyzes information about financial transactions in order to combat domestic and international money laundering, terrorist financing and other financial crimes.

History

In 2001, the USA PATRIOT Act required the US Secretary of the Treasury, Paul O'Neill, to create a secure network for the transmission of information to enforce the relevant regulations. FinCEN’s regulations under Section 314(a) enable federal law enforcement agencies, through FinCEN, to reach out to more than 45,000 points of contact at more than 27,000 financial institutions to locate accounts and transactions of persons that may be involved in terrorist financing and/or money laundering. A web interface allows the person(s) designated in §314(a)(3)(A) to register and transmit information to FinCEN.[citation needed]

Structure