Difference between revisions of "Vulture fund"

(more content) |

m (Text replacement - "==Examples==" to "== Selected Examples ==") |

||

| (16 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

| + | {{concept | ||

| + | |wikipedia=https://en.wikipedia.org/wiki/Vulture_fund | ||

| + | |image=Vulture Fund.jpg | ||

| + | |constitutes=predatory capitalism | ||

| + | |description=Financial groups to profit from the debts of the poor | ||

| + | }} | ||

| + | '''Vulture funds''' are usually{{clarify}} a private equity group or fund that buys defaulted [[debt]] that belongs to individuals, companies or nations. They are criticised as being ruthless<ref>http://www.thisismoney.co.uk/money/markets/article-4542838/How-vulture-lord-son-make-billions.html</ref> in pursuing the debt they have purchased, often negating any gains the debtor has made in managing the debt or pursuing debt relief. They also often engage in payments to government, paying well connected [[lobbyist]]s or making large donations to political parties. | ||

| − | + | ==History== | |

| + | In 1996, there was what Saskia Sassen termed "a groundbreaking moment in the modern history of finance", when a New York judge "broke with long-standing international law and custom, according to which sovereign governments are not sued in regular courts meant to deal with questions internal to a nation state" and agree to hear a case brought by [[Elliott Associates]] for recovery of Panamanian debt.<ref>http://foreignpolicy.com/2014/08/03/a-short-history-of-vultures/</ref> | ||

| − | + | ==Opposition== | |

| + | Vulture fund have been the subject of increasing criticism, and were a target of [[Occupy Wall St]].<ref>http://www.congoresources.org/2011/12/republishing-censored-guardian-article.html</ref> | ||

| − | + | ===Legal restrictions=== | |

| + | [[image:Vulture Fund explanation.jpg|right|550px]] | ||

| + | The [[United Kingdom]] was the first country to impose a legal limit on vulture funds. Since 8 April 2010, vulture funds may not collect payments that the [[World Bank]] deems "unsustainable".<ref>Croft, Adrian. [http://uk.reuters.com/article/idUKTRE63748920100408 "New law limits claims by vulture funds"], Reuters UK website, posted 8 April 2010, accessed 10 April 2010.</ref> | ||

| − | + | On September 9, 2014, the [[UN]] voted 124-11 to create an "historic" new treaty to deal with bankruptcy process of [[nation states]], limiting their exploitation by vulture funds.<ref>[https://www.indybay.org/newsitems/2014/09/09/18761405.php ''International''] "UN Votes for Process to Enact Bankruptcy Treaty and Stop Vulture Funds", 2014</ref> | |

| − | + | ==Victim nations== | |

| − | + | ===Panama=== | |

| − | + | ===Peru=== | |

| + | In 1996 [[Paul Elliot Singer]] purchased Peruvian debt for $11M and then threatened to sue unless he received the full $58M.<ref>http://foreignpolicy.com/2014/08/03/a-short-history-of-vultures/</ref> | ||

| − | |||

| − | Debt Advisory International - | + | ===Zambia=== |

| + | [[Romania]] loaned $40M to [[Zambia]] to buy tractors in 1979, in 1999 unable to keep up the payments they negotiated to settle the debt for $3M but before this could happen Debt Advisory International stepped in and purchased the debt for $4M they then commenced to sue for the original amount plus interest.<ref>http://america.aljazeera.com/articles/2014/3/22/the-end-of-vulturefunds.html</ref> | ||

| − | + | ===Congo=== | |

| + | [[Peter Grossman]] purchased the Congolese debt for a Bosnian state company, [[EnergoInvest]] for $2.6M. He then successfully sued the DRC for $100M.<ref>https://www.theguardian.com/global-development/2011/nov/15/vulture-funds-key-players</ref> | ||

| − | + | ===Argentina=== | |

| − | + | == Selected Examples == | |

| + | * [[Michael Sheehan]] - Debt Advisory International, Donegal International | ||

| + | * Paul Singer - Elliot Management Corporation - Paul Singer is a major donor to the [[Republican Party]] | ||

| + | * Peter Grossman<ref>https://www.theguardian.com/global-development/2011/nov/15/vulture-funds-key-players</ref> - FG Capital Management | ||

| + | {{SMWDocs}} | ||

| + | ==References== | ||

| + | {{reflist}} | ||

Latest revision as of 11:59, 3 May 2022

(predatory capitalism) | |

|---|---|

| |

| Financial groups to profit from the debts of the poor |

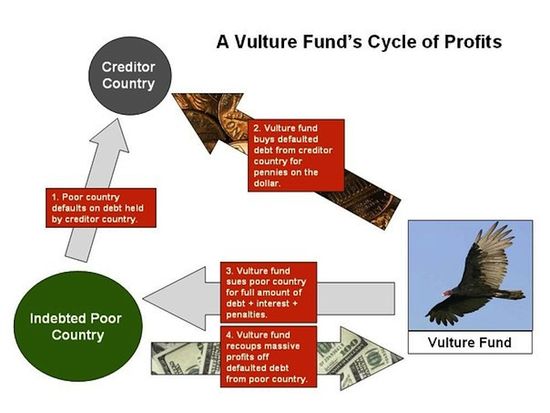

Vulture funds are usually[clarification needed] a private equity group or fund that buys defaulted debt that belongs to individuals, companies or nations. They are criticised as being ruthless[1] in pursuing the debt they have purchased, often negating any gains the debtor has made in managing the debt or pursuing debt relief. They also often engage in payments to government, paying well connected lobbyists or making large donations to political parties.

Contents

History

In 1996, there was what Saskia Sassen termed "a groundbreaking moment in the modern history of finance", when a New York judge "broke with long-standing international law and custom, according to which sovereign governments are not sued in regular courts meant to deal with questions internal to a nation state" and agree to hear a case brought by Elliott Associates for recovery of Panamanian debt.[2]

Opposition

Vulture fund have been the subject of increasing criticism, and were a target of Occupy Wall St.[3]

Legal restrictions

The United Kingdom was the first country to impose a legal limit on vulture funds. Since 8 April 2010, vulture funds may not collect payments that the World Bank deems "unsustainable".[4]

On September 9, 2014, the UN voted 124-11 to create an "historic" new treaty to deal with bankruptcy process of nation states, limiting their exploitation by vulture funds.[5]

Victim nations

Panama

Peru

In 1996 Paul Elliot Singer purchased Peruvian debt for $11M and then threatened to sue unless he received the full $58M.[6]

Zambia

Romania loaned $40M to Zambia to buy tractors in 1979, in 1999 unable to keep up the payments they negotiated to settle the debt for $3M but before this could happen Debt Advisory International stepped in and purchased the debt for $4M they then commenced to sue for the original amount plus interest.[7]

Congo

Peter Grossman purchased the Congolese debt for a Bosnian state company, EnergoInvest for $2.6M. He then successfully sued the DRC for $100M.[8]

Argentina

Selected Examples

- Michael Sheehan - Debt Advisory International, Donegal International

- Paul Singer - Elliot Management Corporation - Paul Singer is a major donor to the Republican Party

- Peter Grossman[9] - FG Capital Management

References

- ↑ http://www.thisismoney.co.uk/money/markets/article-4542838/How-vulture-lord-son-make-billions.html

- ↑ http://foreignpolicy.com/2014/08/03/a-short-history-of-vultures/

- ↑ http://www.congoresources.org/2011/12/republishing-censored-guardian-article.html

- ↑ Croft, Adrian. "New law limits claims by vulture funds", Reuters UK website, posted 8 April 2010, accessed 10 April 2010.

- ↑ International "UN Votes for Process to Enact Bankruptcy Treaty and Stop Vulture Funds", 2014

- ↑ http://foreignpolicy.com/2014/08/03/a-short-history-of-vultures/

- ↑ http://america.aljazeera.com/articles/2014/3/22/the-end-of-vulturefunds.html

- ↑ https://www.theguardian.com/global-development/2011/nov/15/vulture-funds-key-players

- ↑ https://www.theguardian.com/global-development/2011/nov/15/vulture-funds-key-players