Insider trading

(Fraud, White-collar crime) | |

|---|---|

| |

| Type | criminal |

| Trading for your own benefit with knowledge only few have. | |

Insider trading refers to the buying or selling of a security (often also called shares on the stock market in simple terms) on the basis of information that is not available to the public.[1][2][3]

Contents

Friends in high places

| Insider Trading And Congress: How Lawmakers Get Rich From The Stock Market |

Regarding the Clinton family's trading of commodity futures in 1978 and 1979, Marc Joffe of The Fiscal Times wrote:[4][5]

"Under the guidance of an attorney representing Tyson Foods, Hillary Clinton made a $98,540 profit from a $1,000 initial investment in less than one year trading commodity futures. While $98,540 may not seem like much money relative to the Clinton family's wealth today, it exceeded Bill and Hillary's combined annual income at the time"..."In Hillary Clinton's case, her $1,000 initial investment was well below the $12,000 deposit required by the Chicago Mercantile Exchange for the first trades she executed. So not only did Hillary make an extraordinary profit for a novice investor, she did so without following the rules applied to less well-connected traders."

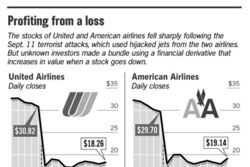

9-11

- Full article: 9-11/Insider trading

- Full article: 9-11/Insider trading

9/11 Commission Report

The 9/11 Commission Report mentioned the name of Buzzy Krongard, former executive director of the CIA, stating:[6]

"A single U.S.-based institutional investor with no conceivable ties to al Qaeda purchased 95 percent of the UAL puts on September 6 (2001) as part of a strategy that also included buying 115,000 shares of American on September 10. Similarly, much of the seemingly suspicious trading on September 10 was traced to a specific U.S.-based options trading newsletter... which recommended these trades."[7]

The implied conclusion is that having "no conceivable ties to al Qaeda" the investor could not have had foreknowledge of the attacks.

Almost Irrefutable Proof?

The German Central bank studied the possibility of insider trading. According to German central bank president Ernst Welteke, the German researchers found “almost irrefutable proof of insider trading”.[8] The Washington Post reported on 23rd September 2001:[9][10]

Welteke said his researchers came across what he considers almost irrefutable proof of insider trading as recently as Thursday, but he refused to release details pending further consultations with regulators in other countries.

"What we found makes us sure that people connected to the terrorists must have been trying to profit from this tragedy," he said at a meeting of European finance ministers and central bankers. Besides massive short selling of airlines and insurance stocks, Welteke said "there was a fundamentally inexplicable rise" in world oil prices just before the attacks that suggest certain groups or people were buying oil contracts that were then sold for a much higher price. He said German researchers also detected movements in gold markets "which need explaining."

"If you look at the movements in markets before and after the attacks, it really makes your brow furrow," Welteke said. "It is extremely difficult to really verify it, but we are confident we will be able to pinpoint the source in at least one or two cases."

Politicians

| Insider Trading in Congress: Ossoff's Plan to Stop Congressional Trading - TLDR News |

While lawmakers who violate the STOCK Act regarding Insider traging face a fine, the penalty is usually small — $200 is the standard amount — or waived by House or Senate ethics officials. On Capitol Hill, lawmakers seriously debated such a ban in 2023, but US Democrats blocked and killed the bill.[11]

At least 97 members of Congress bought or sold stock, bonds or other financial assets that intersected with their congressional work from 2019 to 2021, They also reported similar transactions by their spouse or a dependent child, an analysis by The New York Times has found. When contacted, many of the lawmakers said the trades they reported had been "carried out independently" by a spouse or a broker with no input from them.[12]

Nancy Pelosi

Paul Pelosi, the wealthy spouse of former House Speaker and current Representative Nancy Pelosi, a Democrat from California, divested 30,000 shares of Google stock a month prior to the Department of Justice's declaration of an antitrust lawsuit against the tech giant, as per a financial disclosure submitted to the US House of Representatives. Pelosi disclosed the sale of Google stock in three separate transactions between December 20 and December 28, 2022. Each of these transactions involved the sell of 10,000 shares of stock in Alphabet Inc., Google's parent corporation. The Periodic Transaction Report filed with the House states that each transaction encompassed an amount ranging from $500,001 to $1,000,000 and resulted in capital gains exceeding $200, though the exact profit amount remains unclear. Taken together, these trades involved 30,000 shares and assets valued between $1.5 million and $3 million.[13]

Dianne Feinstein

According to a Business Insider article from 2021, Senator Diane Feinstein reported stock purchases in a biotech company called Allogene Therapeutics in January 2020. The purchases were reportedly made by her husband, Richard Blum, and the disclosed amount was between $50,000 and $100,000. The article highlights that the stock price of Allogene Therapeutics increased significantly after the purchases.[14]

An example

| Page name | Description |

|---|---|

| 9-11/Insider Trading | A mound of evidence points to insider trading. However, the 9/11 Commission decided not to investigate the matter and the SEC destroyed important records. |

References

- ↑ https://www.sec.gov/fast-answers/answersinsiderhtm.html

- ↑ https://www.investopedia.com/terms/i/insidertrading.asp

- ↑ https://economictimes.indiatimes.com/definition/insider-trading

- ↑ https://www.thefiscaltimes.com/Columns/2016/02/02/Why-37-Year-Old-Clinton-Financial-Scandal-Still-Relevant saved at Archive.org saved at Archive.is

- ↑ https://www.businessinsider.com/clinton-futures-scandal-still-relevant-today-2016-2

- ↑ Suppressed Details of Criminal Insider Trading Lead Directly Into The CIA's Highest Ranks

- ↑ Norton, W.W. (2004). 9/11 Commission Report. p. 499.

- ↑ http://www.historycommons.org/context.jsp?item=aearly0901german#aearly0901german

- ↑ William Drozdiak, “‘Insider trading’ by terrorists is suspected in Europe”, Miami Herald, September 24, 2001, http://web.archive.org/web/20011109160700/www.miami.com/herald/special/news/worldtrade/digdocs/099922.htm

- ↑ https://www.washingtonpost.com/archive/politics/2001/09/23/germans-probe-likely-links-between-profits-and-terrorists/1c42fc2d-c092-416c-8594-1e6758b5d86c/ saved at Archive.org saved at Archive.is

- ↑ https://www.businessinsider.com/congress-stock-act-violations-senate-house-trading-2021-9?international=true&r=US&IR=T#sen-dianne-feinstein-a-democrat-from-california-1

- ↑ https://www.nytimes.com/interactive/2022/09/13/us/politics/congress-members-stock-trading-list.html

- ↑ https://www.foxbusiness.com/politics/paul-pelosi-sold-google-shares-prior-doj-antitrust-suit

- ↑ https://www.businessinsider.com/dianne-feinstein-senate-california-stock-purchase-disclosure-2021-1?international=true&r=US&IR=T