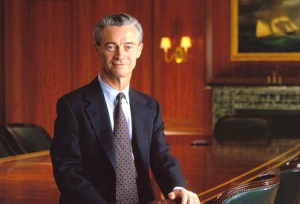

Dennis Weatherstone

(banker, businessman) | ||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||||||||||||

| Born | 1930-11-29 Marylebone, London, England | |||||||||||||||||||||||||||||||

| Died | 2008-06-13 (Age 77) Connecticut, US | |||||||||||||||||||||||||||||||

| Nationality | United Kingdom | |||||||||||||||||||||||||||||||

| Spouse | Marian Blumsun | |||||||||||||||||||||||||||||||

| Member of | Economic Club of New York, Group of Thirty | |||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||

Son of a London transport clerk, after meeting Lewis Preston, Weatherstone rose to become chairman and chief executive officer of J.P. Morgan.

Contents

Background

Born in the UK, he attended the Northwest Polytechnic where he took a night course on banking.[1] He had "a natural grace and friendliness, not the cultivated polish of his Morgan colleagues". He was "modest, charming, and in one account, "a man who walked like a cat"".[1] He never lost his working class accent.[2]

Banking career

In 1946, at age 16, he was hired as a bookkeeper and was quickly promoted to the foreign exchange trading desk at the Guarantee Trust Company in London. He was to be a financier his whole life, and a vocal opponent of government regulation of the financial sector.[citation needed] His national service was a "brief Royal Air Force stint" in Egypt.[1]

Lewis Preston

At some stage Weatherstone made the acquaintence of Lewis Preston (later President of the World Bank and an "old friend" of George H. W. Bush). This was perhaps when Preston was in London in the Eurobond market (1966-1968). Weatherstone has been referred to as a "Preston's protégé... complementary and inseparable". One colleague recollected that "They spoke in a patois. One would start a sentence and the other would finish."[2] while an obituary of Preston's stated that he was "the key figure in [Dennis] Weatherstone's rise".[3]

New York

When Preston returned to New York in 1974, he was accompanied by "his new lieutenant" Dennis Weatherstone. Dennis was quickly promoted, becoming the bank's treasurer in 1977, Vice Chairman and director in 1979 and Chairman of the Executive Committee in 1980.[1]

Financial deregulation

Dennis Weatherstone was at a 1983 meeting in Williamsburg, Virginia, with a group of international bankers, to discuss a disintegration of the U.S. banking system which would force the Senate into accepting IMF control. He stated that this was the only way for the U.S. to save itself.[4]

In the wake of the 1987 stock market crash when Weatherstone asked his division chiefs to put together a briefing to answer the question: "How much can we lose on our trading portfolio by tomorrow's close?" This lead to J.P. Morgan's invention of value-at-risk (VaR) as a tool for measuring exposure to trading losses. In 1987 he became president of the Executive Committee.

J.P. Morgan CEO

In 1990, Weatherstone was named Chairman and Chief Executive Officer of J.P. Morgan, taking over from his friend Lewis Preston. He was knighted by Queen Elizabeth II — the first J.P. Morgan employee to receive the honour. Weatherstone himself was succeeded in 1994 by Douglas Warner III "Sandy".

Legalisation of derivatives

Dennis Weatherstone, who chaired a Group of 30 study group which reported on derivatives in the early 1990s to helped set standards for "best practices." Several on-the-ground analysts have suggested that the group was closely aligned with the would-be regulated (banks) and furthered policy that closely matches their interests and biases. Naturally, the big banks were not looking for increased regulation of the potentially hugely profitable derivatives market. At the time of its release, the New York Times (22 July 1993) described the report this way: “A group of leading financial experts gave a relatively clean bill of health yesterday to the rapidly growing set of financial products called derivatives that some have suggested make the global financial system vulnerable to a widespread crisis.” Janine R. Wedel [5]

Later Activities

In 1999, as "Senior Fellow, Institute for International Economics" he delivered a speech entitled "Safeguarding Prosperity in a Global Financial System".[6] Sir Dennis was an independent member of the member of the Bank of England's Board of Banking Supervision from 1995 through 2001. He was also a board member of Merck & Co., General Motors and the NYSE, and a director of Air Liquide.

References

- ↑ a b c d http://www.ft.com/cms/s/0/92074114-4e16-11dd-820e-000077b07658.html

- ↑ a b The House of Morgan: An American Banking Dynasty and the Rise of Modern Finance By Ron Chernow

- ↑ http://www.independent.co.uk/news/obituaries/sir-dennis-weatherstone-son-of-a-london-transport-clerk-who-became-one-of-the-greatest-bankers-of-the-late-20th-century-874722.html

- ↑ http://www.bibliotecapleyades.net/sociopolitica/history_nwo/history_nwo08.htm

- ↑ http://discoversociety.org/2014/12/01/in-the-shadows-how-unaccountable-elites-corrupt-democracy/

- ↑ http://www.iima.or.jp/en/info_active/meeting/index1999.html